Why Corning Stock Dropped 11.9% Today

Shares of Corning (NYSE: GLW) fell as much as 11.9% in trading on Tuesday after the company reported second-quarter financial results. Shares are down 8.2% as of 3 p.m. ET.

An earnings beat but a guidance flop

Corning reported a modest 3.4% increase in revenue to $3.6 billion and non-GAAP (adjusted) earnings per share was $0.47, which met analyst estimates. But the company guided for $3.7 billion in revenue and earnings of $0.50 to $0.54 per share, which was below the $0.55 in earnings analysts expected.

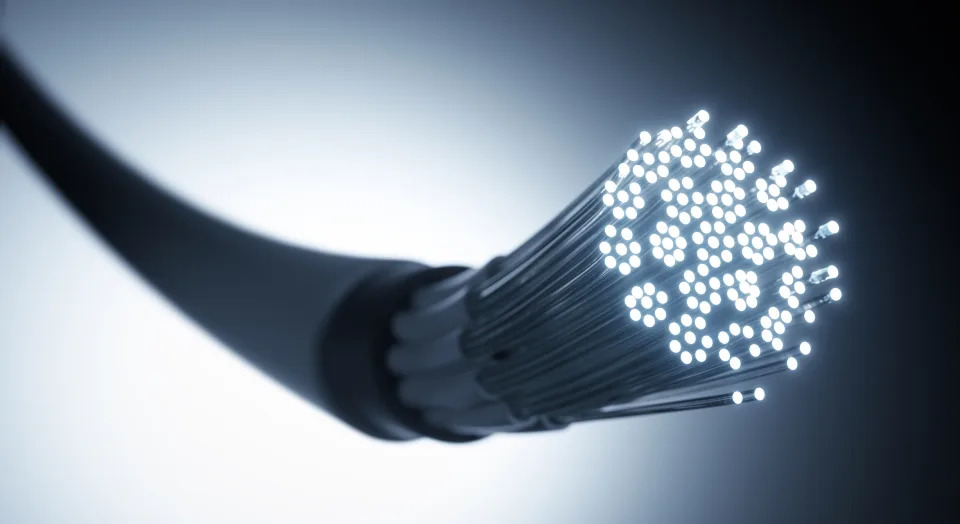

The company also announced a deal with Lumen Technologies to sell 10% of its fiber capacity to the company. This will be used to build faster connections between artificial intelligence (AI) data centers. In theory, this should be a long-term growth channel for the company, although 10% of capacity is not a big percentage of the company's revenue.

Growth is priced in

While modestly better-than-expected results are nice, Corning isn't a high-growth company or a great value for investors. Shares trade for 19 times forward earnings estimates and analysts are only expecting 5.4% growth for the company over the next two years.

Products like AI data centers may get a lot of attention, but I don't think it fundamentally changes the underlying economics of a company like Corning. Manufacturers have had a hard time extracting value from the explosion in tech spending and that continues with Corning. That's why I'm not buying the discount in shares today.

Before you buy stock in Corning, consider this: