Starbucks expected to report weak sales as it pushes popping pearls and value plays

Starbucks ( SBUX ) investors are cautious ahead of its Tuesday earnings report.

Its shares are down nearly 28% compared to a year ago, when the coffee giant painted a picture of a resilient consumer with a 10% sales growth. Now, different expectations are on tap.

Q3 revenue is expected to grow 0.37% to $9.20 billion, per Bloomberg consensus estimates. Adjusted earnings per share are expected to be $0.92, compared to $1.00 a year ago.

Same-store sales are expected to decline for the second quarter in a row, down 2.71%, while overall foot traffic is expected to drop 4.27%.

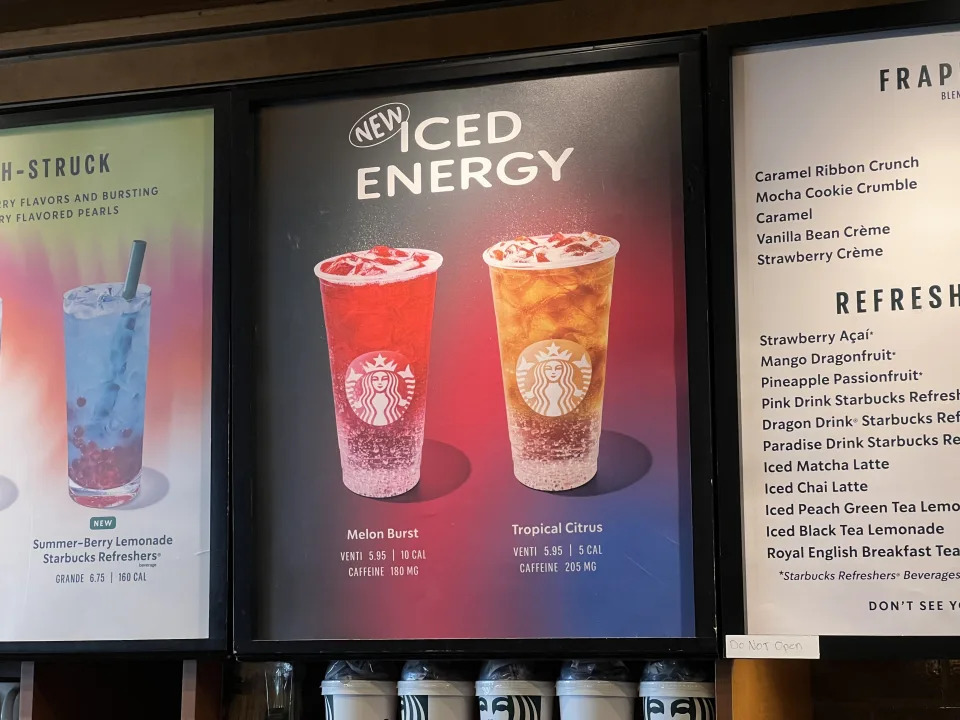

The size of the average check is estimated to be up 1.98% as menu prices increase. This may also be boosted by new items launched during the quarter like popping boba-like pearls and iced energy drinks. It launched a limited-time “pairing menu," which allows customers to get a small iced or hot coffee with a butter croissant or breakfast sandwich for $5 or $6.

This may not have turned the tide enough.

"We believe US same-store sales remained weak in Q3 despite a meaningful increase in promotional activity and several product launches in the quarter," Deutsche Bank analyst Lauren Silberman wrote in a note to clients. She has a Hold rating on the stock.

She added "sentiment on Starbucks continues to lean negative ... [it] has been less topical than other large caps and relative to the past few quarters."

"Cyclical macro issues" may be to to blame, per a note from Baird analyst David Tarantino. He expects softness in the majority of fiscal 2024 sales as consumers pull back on discretionary spending, "including afternoon occasion at Starbucks." He has a Hold rating on shares.

This earnings report comes as pressure is mounting from activist investor Elliott Investment Management, which took an undisclosed stake in the company, according to a report from WSJ .

"Investors have questioned Elliott’s experience and track record in the consumer sector, we believe that an external nudge may accelerate making bold decisions and may offer interesting risk-reward opportunities for long-term investors willing to accept that a turnaround may take time," Bernstein analyst Danilo Gargiulo wrote in a note to clients.

Here are 10 items Gargiulo believes the Elliot team would prioritize.

Improving results in its second-largest market, China, is also much needed.

Last quarter, China saw the biggest drop of all Starbucks segments, with same-store sales down 11%, foot traffic down 8%, and the average ticket size down 4%. This quarter, Wall Street expects roughly the same, with sales down 10.58%.

"Performance was impacted by a decline in occasional customers, changing holiday patterns, a high promotional environment, and a normalization of customer behaviors following last year's market reopening," CEO Laxman Narasimhan said on his last earnings call.

In a note to clients, Bank of America analyst Sara Senatore said Starbucks' performance in China is tied to industrywide struggles.

"Intense competition is the natural state of restaurant markets and even the strongest brands are not insulated," she said. "The direction of SBUX's China same-store sales growth is strongly correlated with those of other global brands. And all are correlated with macro factors (GDP)."

McDonald's ( MCD ) pointed to declining sales growth in China in its Q2 results as consumer sentiment remains weak in a competitive environment.

Gargiulo believes franchising may be the way to go in the market with an "equally compelling alternative to leverage buildout of one of the biggest coffee market without the capital allocation" and less exposure to "fluctuating macro-economic conditions."

The company still aims to have 9,000 locations in China by 2025.

Earnings preview

Here's what Starbucks is expected to report, based on Bloomberg consensus data, compared to Q3 2023:

Revenue: $9.20 billion compared to $9.17 billion

Adjusted earnings per share: $0.92 compared to $1.00

Same-store sales: -2.71% compared +10%

Foot traffic: -4.27% compared to 5.00%

Ticket Growth: 1.98% compared to 4%

Following Q2, Starbucks revised its 2024 outlook for the third time this fiscal year.

It expects 2024 global revenue growth of low-single digits, down from the previous range of 7% to 10%, which itself was down from a prior guidance of 10% to 12%.

Global and US same-store sales are expected to see a low single-digit decline or stay flat, down from the previous range of 4% to 6% growth. China's same-store sales are expected to see a single-digit decline, down from the previously expected low-single-digit growth.

—

BrookeDiPalma