1 Nasdaq ETF to Buy With $1,000 and Hold Forever

Along with the S&P 500 and Dow Jones , the Nasdaq Composite is one of the three main indexes in the U.S. stock market. It tracks virtually every company listed on the Nasdaq stock exchange. The Nasdaq-100 is a subset of the Nasdaq Composite and tracks the largest 100 non-financial companies listed.

Investors wanting exposure to the Nasdaq should consider the more concentrated Nasdaq-100 . The newly formed Invesco Nasdaq 100 ETF (NASDAQ: QQQM) is a great option and comparable to the more widely known Invesco QQQ ETF (the second-most-traded ETF in the U.S.).

If you have $1,000 available to invest (ideally with an emergency fund saved and high-interest debt paid down), this ETF can provide great growth potential.

Gaining a lot of exposure to the tech sector without going all-in

The Nasdaq-100 is a great go-to for people who want a lot of tech sector exposure. Although the ETF contains companies from every major sector, it's heavily skewed toward the tech sector:

Investors seeking truly diversified ETFs don't generally choose a Nasdaq-100 ETF, but it's a great option for people who want the benefits of investing in many of the top tech companies while also hedging their portfolios with large-cap companies from other sectors.

The tech sector has long been the stock market's darling, but the past five years have seen many top tech companies' valuations explode. In August 2018, Apple became the first company to reach a trillion-dollar market cap. Roughly six years later, its market cap is over $3.3 trillion, and seven companies are over the $1 trillion mark.

Recent performance that shows how attractive the ETF can be

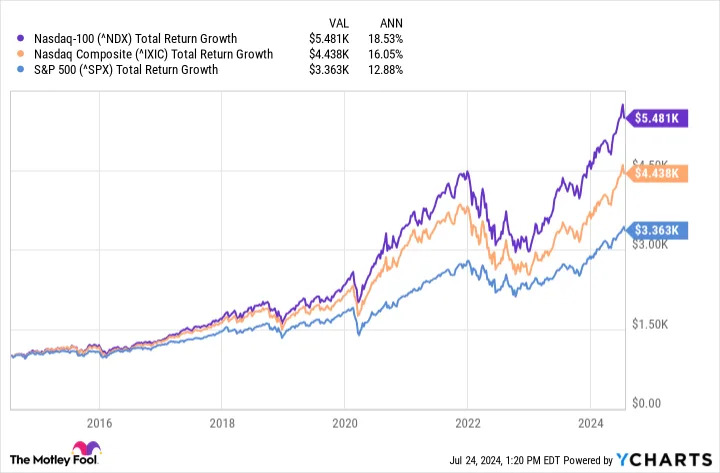

The newly formed Invesco Nasdaq 100 ETF has only been around since October 2020, so I'll focus on the Nasdaq-100 index to show how well it has performed over time. In the past 10 years, the Nasdaq-100 has increased by around 450%, handily outperforming the Nasdaq Composite (340%) and S&P 500 (235%).

Here's how a $1,000 investment in each index a decade ago would roughly stack up today.

The Nasdaq-100's past success doesn't guarantee it'll continue, but it's being led by some of the world's top companies that have great growth opportunities ahead of them. The " Magnificent Seven ," a group of tech companies known for their industry dominance and innovation, account for close to 43% of ETF. The other three companies that round out the ETF's top 10 holdings are Broadcom , Costco Wholesale, and Netflix :

Within these companies alone, you're exposed to many high-growth industries, including cloud computing, semiconductors, electric vehicles, digital advertising, and the full spectrum of all things AI-related. If these companies have the long-term growth they're expected to enjoy, the ETF will be in good hands.

This slight difference in fees matters over the long run

Even though Invesco already had a popular Nasdaq-100 ETF, Invesco QQQ ETF, I believe it created the Invesco Nasdaq 100 ETF to be more appealing to retail investors. Since they both mirror the same index, there isn't too much tangible difference between them besides the expense ratios.

The Invesco Nasdaq 100 ETF's expense ratio is 0.15% compared to the Invesco QQQ ETF's 0.20%. This slight 0.05% difference is small in theory but can add up more than people may realize.

Let's imagine a situation where you invest $500 monthly and average 10% annual returns. Here are roughly the differences in fees paid over different years:

|

Expense Ratio |

Fees Paid in 15 Years |

Fees Paid in 20 Years |

Fees Paid in 25 Years |

|---|---|---|---|

|

0.15% |

$2,250 |

$5,800 |

$13,150 |

|

0.20% |

$3,000 |

$7,710 |

$17,460 |

Fees are rounded to the nearest 10.

You could save yourself thousands over the years by investing in virtually the same investment. If you already own the Invesco QQQ ETF, it makes sense to hold onto it to avoid potential capital gains and the relevant taxes, but if you're just now adding a Nasdaq-100 ETF to your portfolio, the Invesco Nasdaq 100 ETF makes financial sense.

Before you buy stock in Invesco NASDAQ 100 ETF, consider this: