Acadia Healthcare (NASDAQ:ACHC) Misses Q4 Revenue Estimates, Stock Drops 13.9%

Behavioral health company Acadia Healthcare (NASDAQ:ACHC) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 4.2% year on year to $774.2 million. Next quarter’s revenue guidance of $770 million underwhelmed, coming in 5.8% below analysts’ estimates. Its non-GAAP profit of $0.64 per share was 10.4% below analysts’ consensus estimates.

Is now the time to buy Acadia Healthcare? Find out in our full research report .

Acadia Healthcare (ACHC) Q4 CY2024 Highlights:

Company Overview

Founded in 2005, Acadia Healthcare (NASDAQ:ACHC) is a provider of specialized behavioral healthcare services, operating inpatient psychiatric hospitals, residential treatment centers, and outpatient clinics.

Hospital Chains

Hospital chains operate scale-driven businesses that rely on patient volumes, efficient operations, and favorable payer contracts to drive revenue and profitability. These organizations benefit from the essential nature of their services, which ensures consistent demand, particularly as populations age and chronic diseases become more prevalent. However, profitability can be pressured by rising labor costs, regulatory requirements, and the challenges of balancing care quality with cost efficiency. Dependence on government and private insurance reimbursements also introduces financial uncertainty. Looking ahead, hospital chains stand to benefit from tailwinds such as increasing healthcare utilization driven by an aging population that generally has higher incidents of disease. AI can also be a tailwind in areas such as predictive analytics for more personalized treatment and efficiency (intake, staffing, resourcing allocation). However, the sector faces potential headwinds such as labor shortages that could push up wages as well as substantial investments needs for digital infrastructure to support telehealth and electronic health records. Regulatory scrutiny, and reimbursement cuts are also looming topics that could further strain margins.

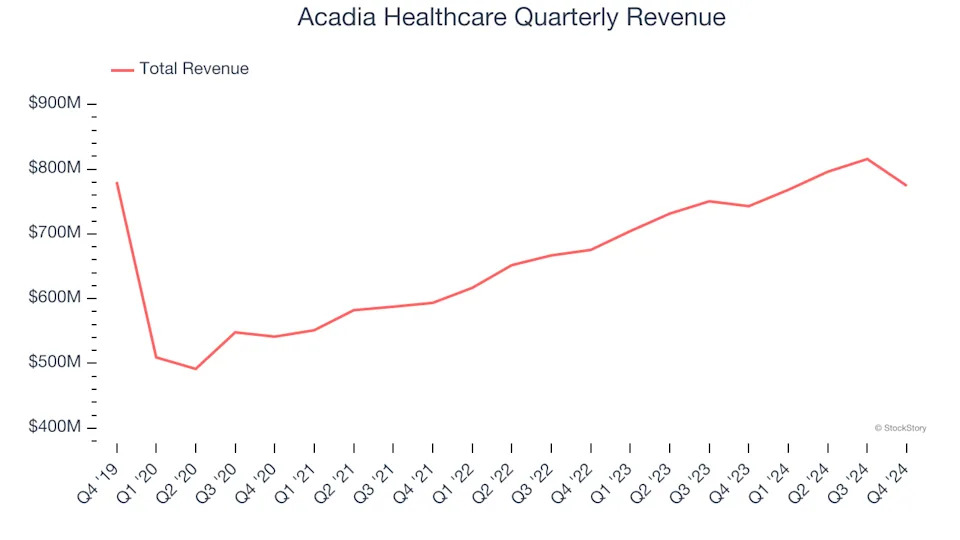

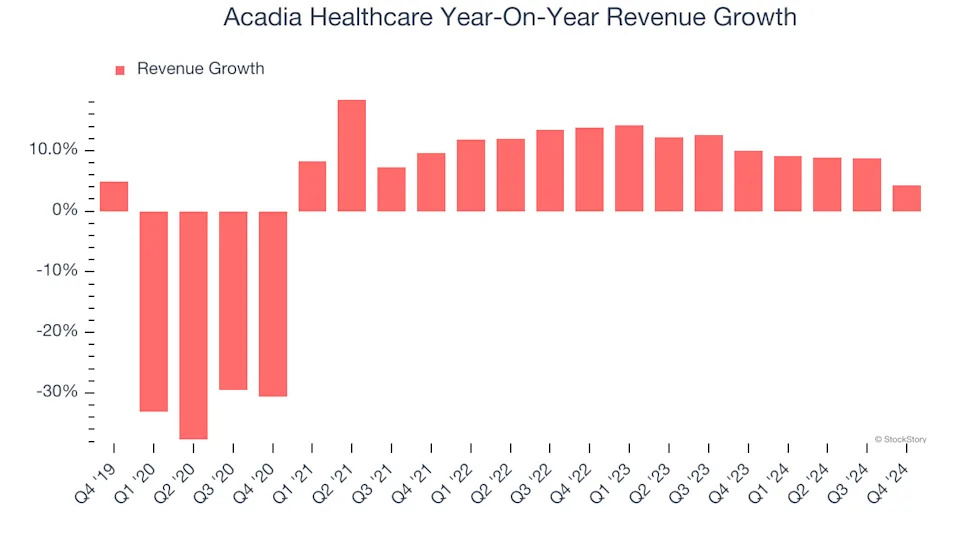

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Acadia Healthcare struggled to consistently increase demand as its $3.15 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a lower quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Acadia Healthcare’s annualized revenue growth of 9.9% over the last two years is above its five-year trend, suggesting some bright spots.

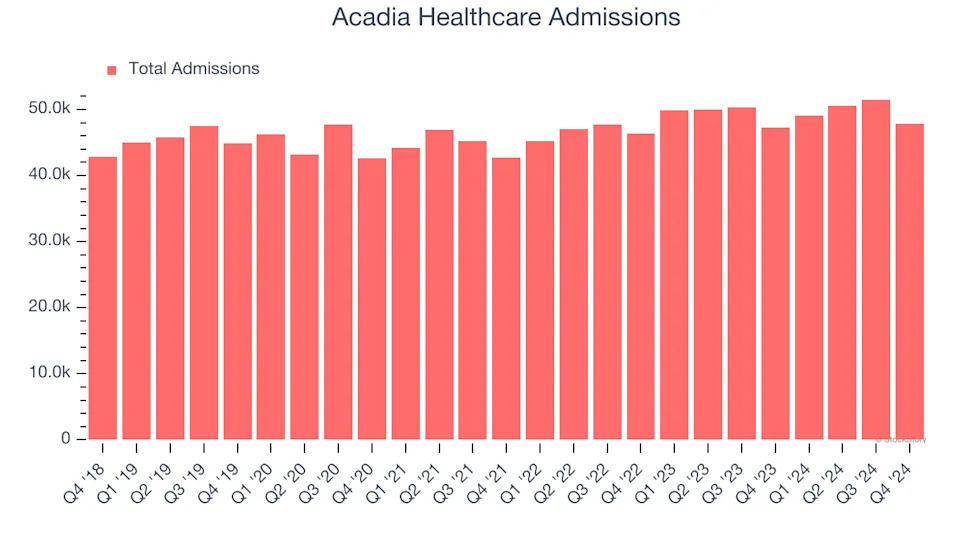

We can dig further into the company’s revenue dynamics by analyzing its number of admissions, which reached 47,866 in the latest quarter. Over the last two years, Acadia Healthcare’s admissions averaged 3.4% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Acadia Healthcare’s revenue grew by 4.2% year on year to $774.2 million, falling short of Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, similar to its two-year rate. Despite the slowdown, this projection is commendable and implies the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

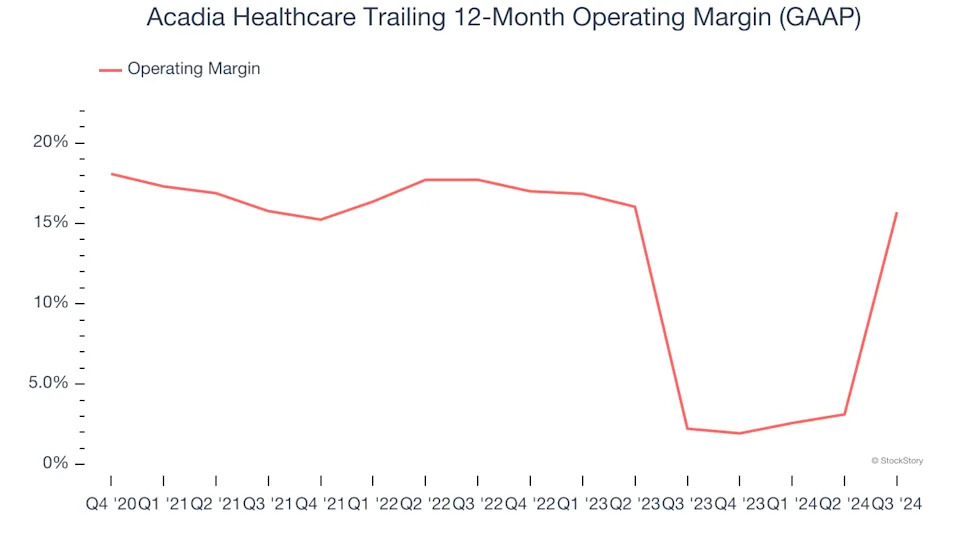

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Acadia Healthcare has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.2%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Acadia Healthcare’s operating margin might fluctuated slightly but has generally stayed the same over the last five years.

in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

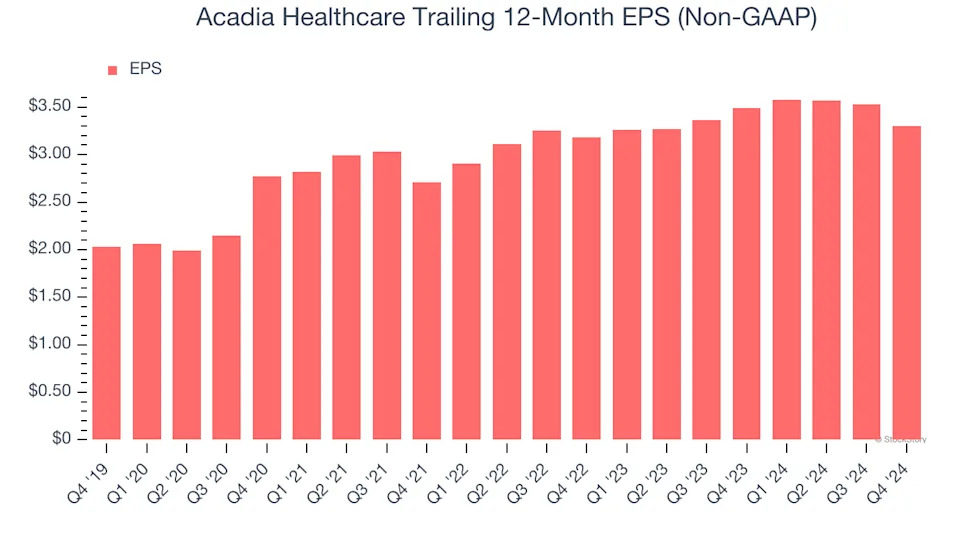

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Acadia Healthcare’s EPS grew at a remarkable 10.2% compounded annual growth rate over the last five years, higher than its flat revenue. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Acadia Healthcare reported EPS at $0.64, down from $0.87 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Acadia Healthcare’s full-year EPS of $3.30 to grow 2.1%.

Key Takeaways from Acadia Healthcare’s Q4 Results

We struggled to find many positives in these results. Its revenue guidance for next quarter missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 13.9% to $34.65 immediately after reporting.

The latest quarter from Acadia Healthcare’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .