ICU Medical (NASDAQ:ICUI) Surprises With Q4 Sales

Medical device company ICU Medical (NASDAQ:ICUI) reported Q4 CY2024 results beating Wall Street’s revenue expectations , with sales up 7.1% year on year to $629.8 million. Its non-GAAP profit of $2.11 per share was 42.4% above analysts’ consensus estimates.

Is now the time to buy ICU Medical? Find out in our full research report .

ICU Medical (ICUI) Q4 CY2024 Highlights:

Vivek Jain, ICU Medical’s Chief Executive Officer, said, “Fourth quarter results were generally in line with our expectations with the exception of higher IV solutions revenues due to the U.S. market shortage.”

Company Overview

Founded in 1984, ICU Medical (NASDAQ:ICUI) provides medical devices and systems for infusion therapy, vascular access, and oncology (cancer) care.

Medical Devices & Supplies - Cardiology, Neurology, Vascular

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

Sales Growth

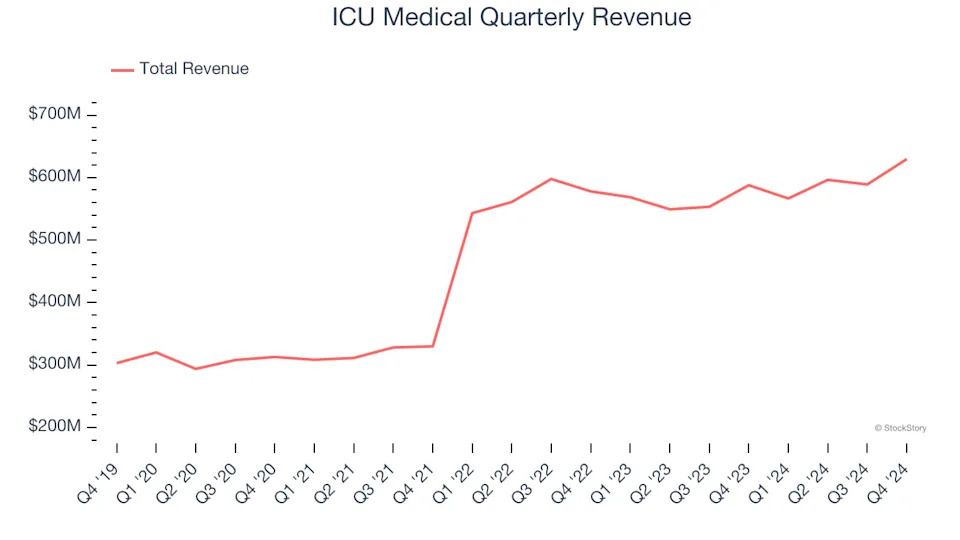

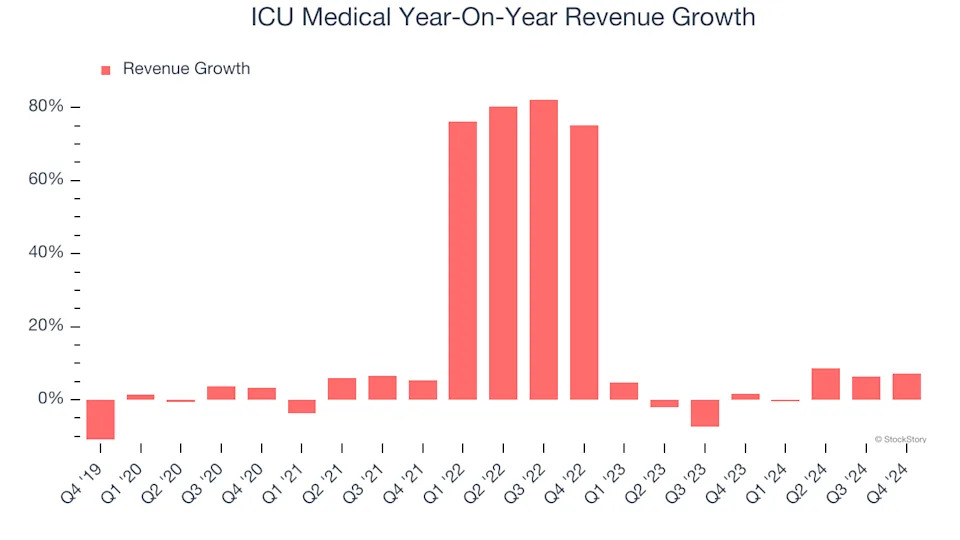

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, ICU Medical’s 14.5% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. ICU Medical’s recent history shows its demand slowed as its annualized revenue growth of 2.2% over the last two years is below its five-year trend.

ICU Medical also breaks out the revenue for its most important segment, . Over the last two years, ICU Medical’s revenue averaged 3.3% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, ICU Medical reported year-on-year revenue growth of 7.1%, and its $629.8 million of revenue exceeded Wall Street’s estimates by 7.6%.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

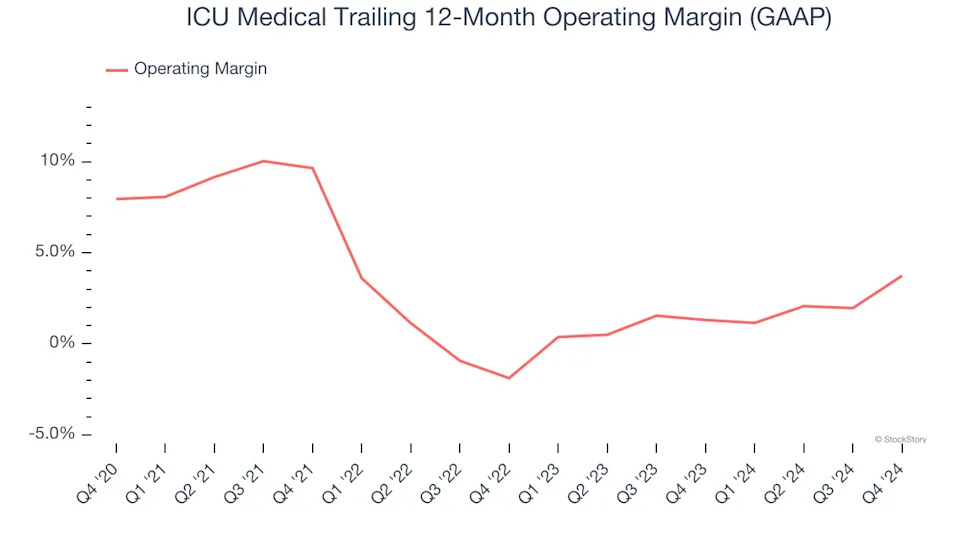

ICU Medical was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.1% was weak for a healthcare business.

Analyzing the trend in its profitability, ICU Medical’s operating margin decreased by 4.2 percentage points over the last five years, but it rose by 5.6 percentage points on a two-year basis. Still, shareholders will want to see ICU Medical become more profitable in the future.

This quarter, ICU Medical generated an operating profit margin of 6%, up 6.9 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

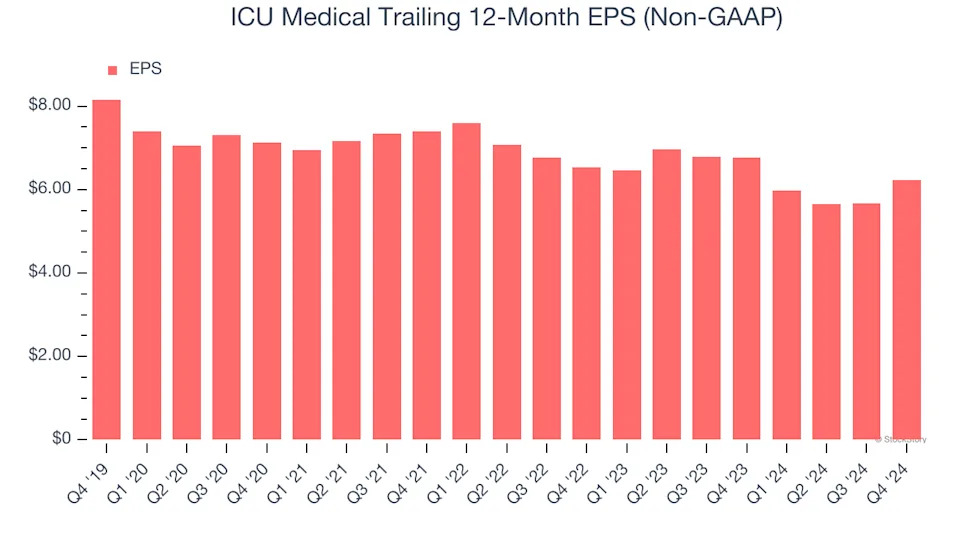

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for ICU Medical, its EPS declined by 5.3% annually over the last five years while its revenue grew by 14.5%. This tells us the company became less profitable on a per-share basis as it expanded.

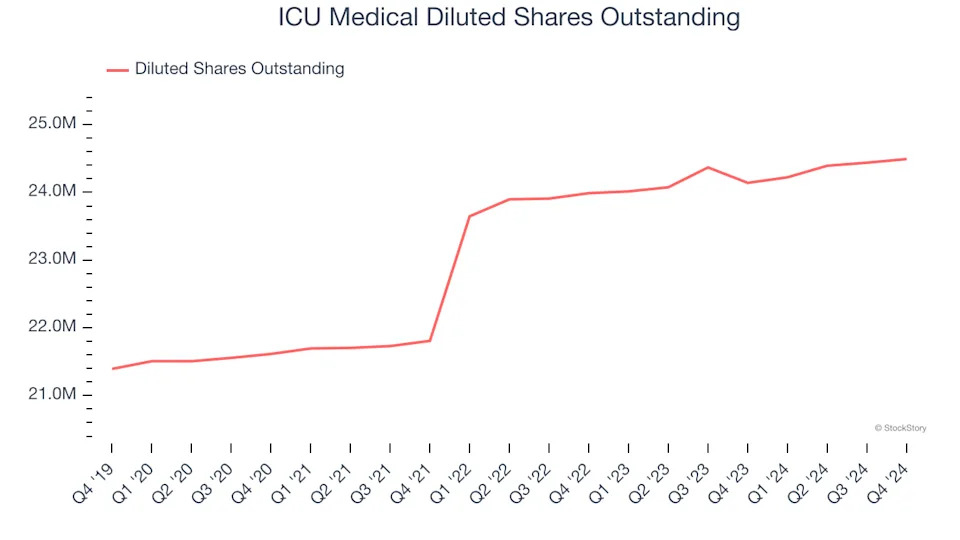

We can take a deeper look into ICU Medical’s earnings to better understand the drivers of its performance. As we mentioned earlier, ICU Medical’s operating margin improved this quarter but declined by 4.2 percentage points over the last five years. Its share count also grew by 14.5%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, ICU Medical reported EPS at $2.11, up from $1.57 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ICU Medical’s full-year EPS of $6.22 to grow 11.9%.

Key Takeaways from ICU Medical’s Q4 Results

We were impressed by how significantly ICU Medical blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EPS guidance missed. Overall, this quarter was mixed. The stock remained flat at $150 immediately after reporting.

ICU Medical put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .