Crypto narratives: How the absence of earnings fuels investor fervor

The following is a guest post from Shane Neagle, Editor In Chief from The Tokenist.

Not all narratives are created equal.

In the age of digital financial platforms, investing in all kinds of assets has never been easier. This is happening at a time when the stakes are both clear and high. In order to outpace the erosion of money due to central banking, otherwise known as inflation, investing has to yield sustained high single-digit returns at a bare minimum.

But in a rush to outpace inflation, in addition to offset capital gains tax, investing has become akin to gambling. This is especially apparent in the blockchain space. To become more resilient when staking an asset, what should investors keep in mind?

Barrier to Entry: Stocks vs Cryptos

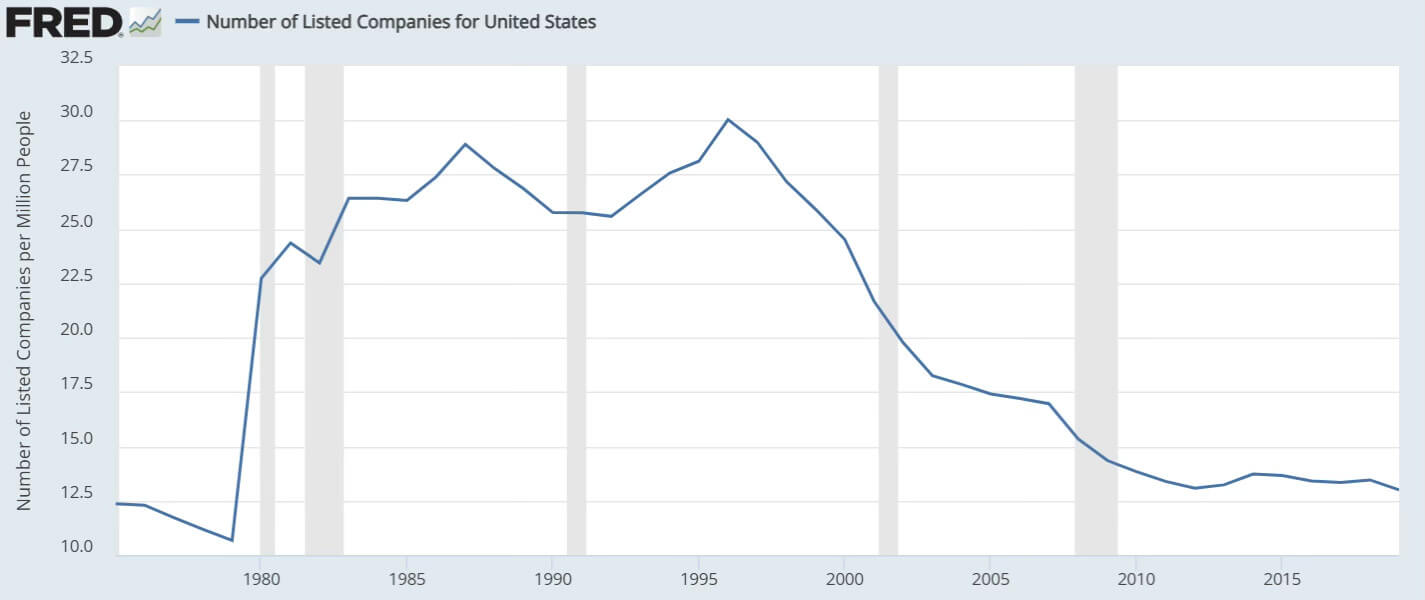

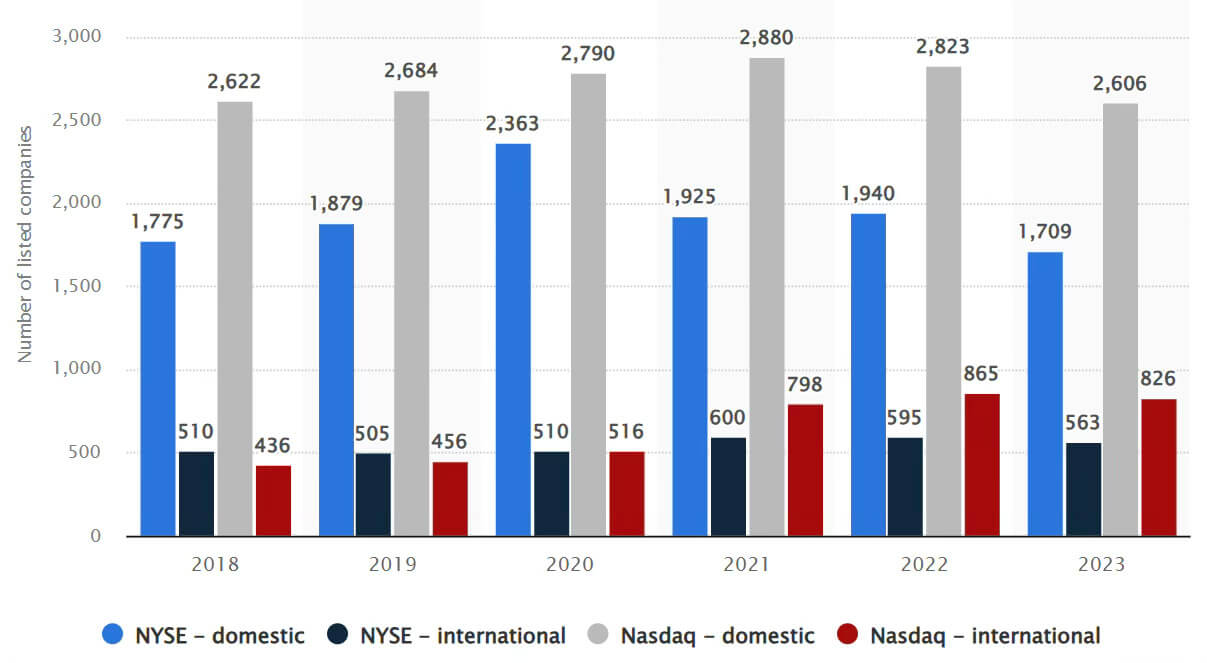

Lowering the barrier to entry works both ways in the crypto world, but not so much in the stock world. On one hand, people have easier access to capital, but on the other hand, companies face increased scrutiny and regulatory burden by going public. This is evident by the stocks drop off since the mid-1990s, having fallen by 56% by 2020 from over 8,000 stocks.

Because publicly traded companies are based on physical operations that exert expenditures and require quarterly financial reports, there is a cycle of inflows and drop offs.This leaves the number of stocks at approximately the same level, reliant on business cycles.

In other words, stocks have an inherent barrier to entry, from the side of businesses, which also serves as a signal for value. The same is not the case for digital assets. Notwithstanding cryptocurrencies based on the proof-of-work algorithm like Bitcoin , the vast majority of crypto coins are based on proof-of-stake consensus.

This means there is no longer a requirement for infrastructure in the form of mining hardware and electricity. In turn, there is no crypto equivalent when it comes to expenditures and earnings. Likewise, funded and generalized proof-of-stake platforms like Ethereum, BSC, Solana or Avalanche serve as a launching pad for easy token creation.

These factors are driving the number of cryptocurrencies to ever increasing heights, greatly overshadowing the number of stocks at 16,218 (at press time). All of these coins compete for a finite amount of capital and human attention, which means the more tokens are birthed the greater the dilution effect.

Narrative Creation as a Substitute for Earnings

Not only is it easy to create cryptocurrencies ex nihilo , but it is also easier to access them via self-custodial wallets and decentralized exchanges. At first glance, this may seem beneficial, but does it benefit people’s portfolios?

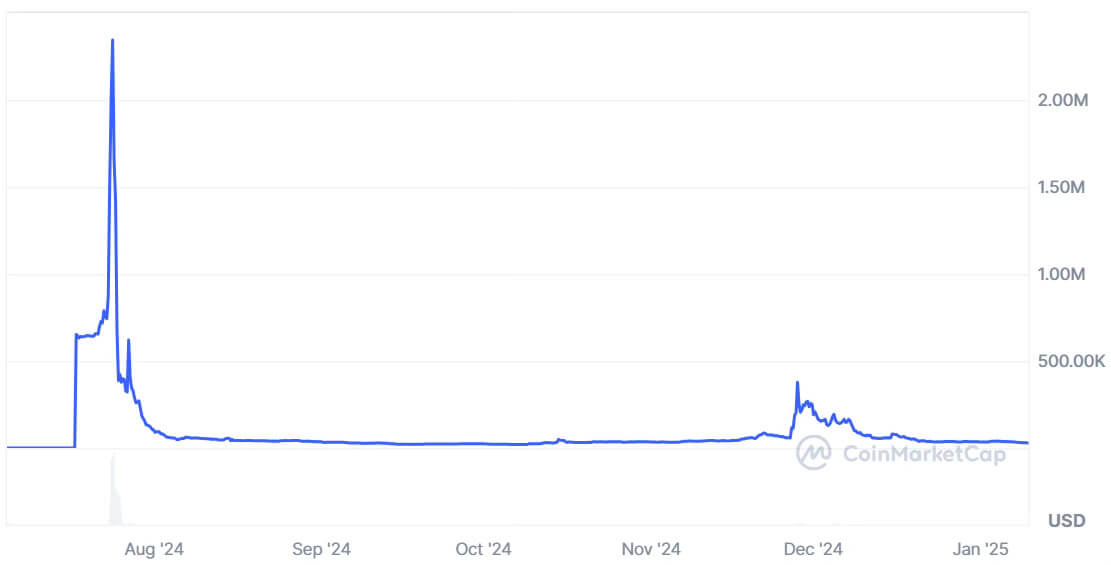

Among countless examples in the negative direction is the recent Hawk Tuah (HAWKTUAH) coin, having dropped by 99.14% in value since its inception in July.

In the absence of quarterly earnings, and boosted by ease of entry, crypto traders have become reliant on “vibes”, or narratives:

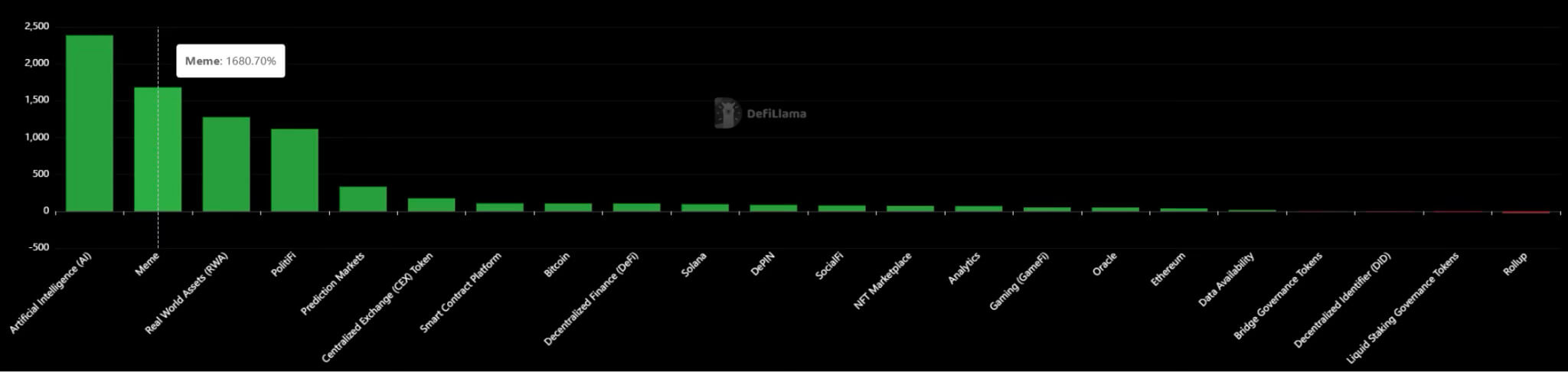

The exact same principle exists in the lottery. Because it is known that some people won lottery tickets, the potential for life-changing gains is established, regardless how remote it actually is. This is why the memecoin narrative has been so performant over the last year, as a market cap-weighted category.

Of course, that “performance” accounts for the flood of memecoins that increased the market cap and opened up new narrative gambling opportunities. In actuality, most traders lose money based on such narratives. According to Pump.fun at Dune Analytics, 60% of memecoiners lost their narrative bets.

A REMINDER THAT:

• 60% of all memecoin traders lost money trading memecoins.

• 4.7% made no money.

• 24% made less than $100.

• 11.2% made more than $100.

• 3% made more than $1,000.

• 0.5% made more than $10,000.

• People who have made more than $10K can barely… pic.twitter.com/ADakThjOcX

— Kermit 🐸 (@crypto__kermit) November 19, 2024

Although it is easy to see how memecoin trading is a simulacrum of gambling, these digital assets are traded equally with other coins. This includes

Bitcoin

with its fixed scarcity and vast computing infrastructure to anchor it into the physical world.

Consequently, it is fair to say that some crypto narratives have a draining effect on the wider crypto market. After all, those capital inflows could have been better served elsewhere. But where exactly (excluding Bitcoin as the obvious candidate)?

Spotting Fresh Crypto Narratives in a Low Barrier to Entry Field

Just like the AI boom endowed Nvidia (NASDAQ: NVDA) with over $3 trillion market cap, the AI narrative has become dominant in the crypto space, even outpacing memecoins. Notwithstanding the buzzwordiness, what exactly does AI + blockchain bring to the crypto table?

It turns out, these technologies are perfectly complementary. Blockchain represents trustless networks, which are prerequisites for autonomous AI agents to operate without centralized oversight. For instance, AI agents could be used to automate tasks such as managing portfolios or yields on DeFi platforms.

In other words, they have the potential to turn digital assets into passive income streams. Virtuals Protocol (VIRTUAL) makes it possible to create and co-own AI agents, which will then interact with a wide range of blockchain networks. This potential already skyrocketed VIRTUAL token, having gained over 5,000% value in the last three months.

Similarly, ai16z (AI16Z), inspired by entrepreneur Marc Andreessen who co-founded venture capital firm Andreessen Horowitz (a16z), is the first AI-governed Decentralized Autonomous Organization ( DAO ). Serving as a utility token, AI16Z pays for activities within this virtual fund to automatically trade tokens on DeFi platforms, post social media content or browse the web to glean insight.

Over the last month, AI16Z gained 90% of value.

Another notable project is NeuralAI (NEURAL), as a part of a wider ecosystem in which AI agents generate 3D objects from text descriptions. Although down 30% over the month, NEURAL token gained 911% value over the last year.

Likewise, Morphware (XMW) gained 291% value in the same period. This project aims to decentralize computing power needed for AI infrastructure, with XMW monetizing GPU hardware across a peer-to-peer network.

Where Is AI+Blockchain Going?

With 83% of companies stating AI is their top priority , many are already thinking about how blockchain fits in this new world order. If AI already has the capacity to generate coherent text based on input sentiment, it is not far off in analyzing market sentiment as well. In turn, machine learning (ML) and natural language processing (NLP), could end up systematizing complex derivatives trading such as futures contracts by leveraging technical indicators and social media content.

In fact, such AI agents could be more adept at trading volatile memecoins as they churn out social media narratives 24/7. Namely, they could pick just the right time frame to enter and exit the market. Of course, this would end up in an agent-vs-agent trading landscape.

However, just like in a traditional arms race, such an environment could amplify the value of AI agent-centric tokens, in addition to their supporting infrastructure. And just as lottery spectacles aren’t going away due to their potential, memecoins are likely to stay as well. But with emerging AI projects focused on trading, at least memecoins could work off their capital drain.