AI boom masks fundraising struggles for non-AI startups

Earlier this year, IVP general partner Tom Loverro proclaimed that the post-pandemic downturn is over, and companies that made it this far should prioritize growth over cost-cutting.

Yet, the companies still struggling to raise their next round of financing at a higher valuation or survive altogether could still be in the thousands, according to Brian Hirsch, co-founder of Tribeca Venture Partners.

The 13-year-old firm has a late-stage strategy that, unlike conventional growth funds, invests in companies forced to raise capital at a valuation that’s the same or lower than their last price. In many of these situations, existing investors are ready to support the company with additional funding, but they need a third party like Tribeca Ventures to value the deal, Hirsch told TechCrunch.

VCs are excited to back AI companies at red-hot valuations, “but everything else is really challenged,” Hirsch said.

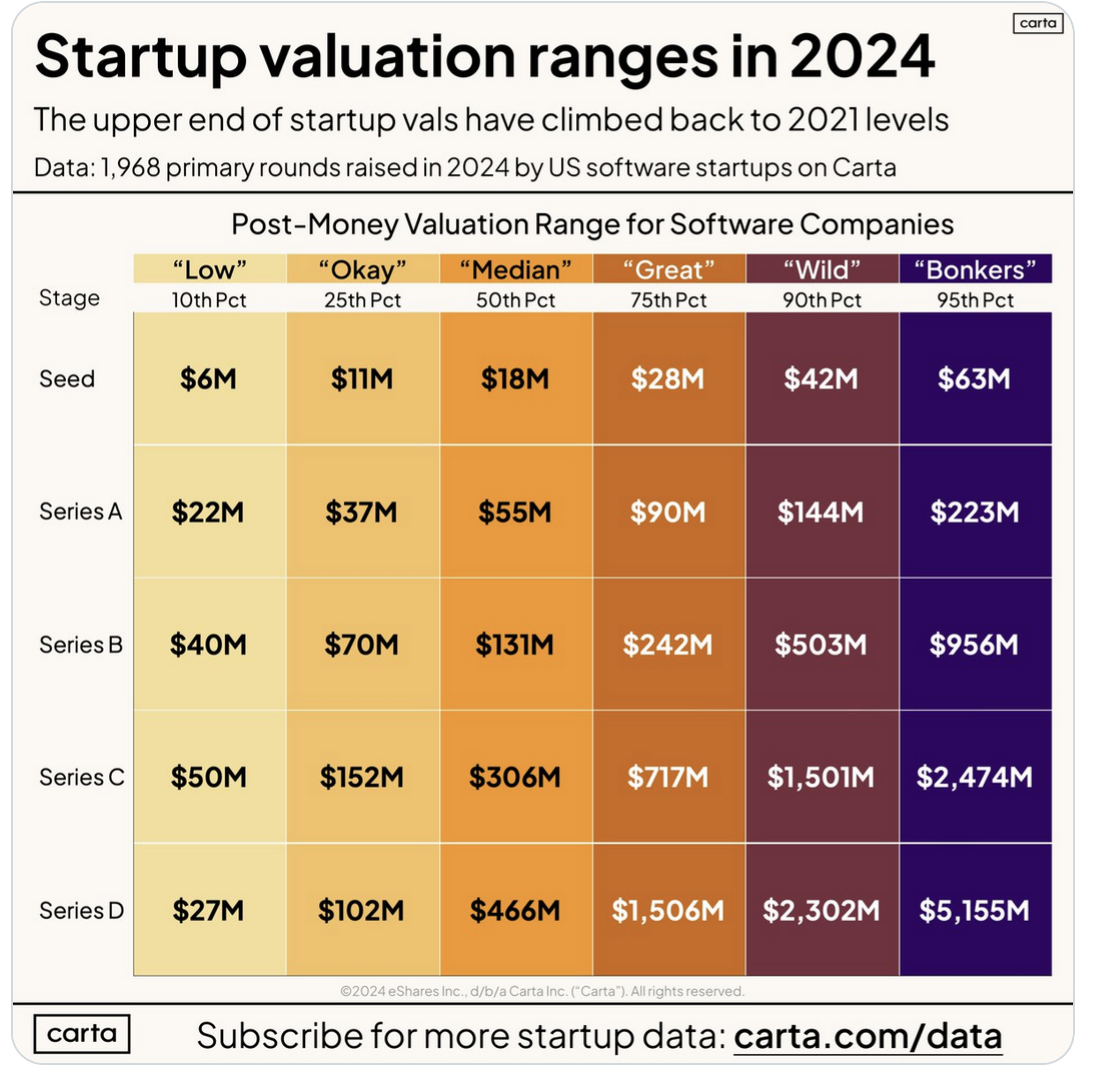

Nothing proves more just how much of a tale of two cities venture has become than the latest valuation data from Carta. The cap-table management platform analyzed nearly 2,000 software deals that closed this year and found that the bottom 10% of Series B deals had a pre-money valuation of only $40 million, meanwhile, the top 10% of companies at the same stage of development were priced at almost $1 billion.

The price dispersion was even more stark for Series D deals, ranging from a mere $27 million to $5.2 billion.

The companies at the upper end of the range are undoubtedly doing something having to do with AI. Notable examples include ElevenLabs , which raised a $920 million Series B earlier this year, valuing the company at $920 million pre-money , and Cohere , which closed its Series D at a $5 billion pre-money valuation.

For non-AI startups, the fundraising landscape is drastically different, even if they raised capital after the ZIRP-era frenzy subsided.

Non-AI companies that raised a Series A round 18 months ago are likely facing challenges in securing Series B funding, even with decent revenue growth, Hirsch said.

Founders of non-GenAI startups must feel like “in high school, and they didn’t get invited to the cool party,” Hirsch said, adding that they often have a good business, but nobody cares.

Indeed, Carta’s data reveals that only 9% of Series A companies have been able to secure Series B funding within two years, a significant decline from the previous 25%.

However, Tribeca Ventures is using its growth fund to help price down rounds of more mature startups, primarily companies that have revenues of $20 million or above.

Many of these startups are growing at a decent pace, but their valuations are too high for the current market.

“We’re still in that unwinding process,” Hirsch said. “We think it’s at least a couple years more clean-up work.”