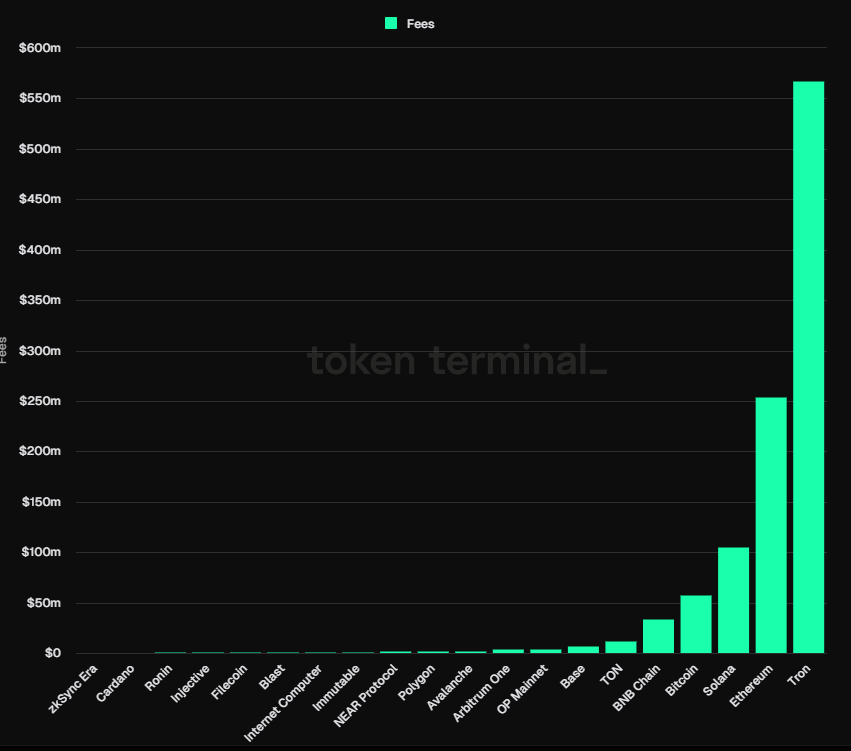

Tron’s $566 million Q3 revenue surpasses Bitcoin, Ethereum and Solana

Tron generated total revenue of $566 million in the third quarter, placing it ahead of giants like Ethereum , Solana , and Bitcoin .

The figure reflects a 43% increase compared to the network’s second-quarter earnings. Over the past year, Tron has generated approximately $1.66 billion in total revenue, marking a 113% year-on-year growth.

Token Terminal shows that Tron’s third-quarter revenue was more than 2x higher than Ethereum’s $253 million, 5x higher than Solana’s $105 million and 9x greater than Bitcoin’s $57 million.

Reacting to the results, Tron founder Justin Sun voiced optimism for the final quarter of the year, stating:

“We are confident that Q4 will see even more growth compared to Q3.”

Robust stablecoin activity

Tron’s revenue spike was primarily driven by its robust stablecoin activity and the growing memecoin sector on the network.

DeFillama data reveals that Tron is the second-largest blockchain for stablecoins, controlling 34.8% of the market and supplying $59.8 billion in stablecoins.

The network’s stablecoin supply grew 21.6% this year, driven largely by demand for Tether’s USDT, which accounts for 98.3% of the stablecoins on Tron. USDT is the largest stablecoin in the crypto market, with a market cap of roughly $120 billion.

Market observers noted that Tron’s low fees and fast transactions drive its popularity in emerging markets like Nigeria and Argentina. In these regions, users increasingly turn to stablecoins to shield against their volatile local currencies and also as a form of exposure to the US Dollars.

Additionally, the recent launch of SunPump, a memecoin launchpad, has boosted Tron’s visibility within the industry and contributed significantly to the increased network activity.

Token Terminal noted that daily transactions on the Tron network exceed 8 million, fueled by stablecoin transfers and the memecoin frenzy .

Consequently, the network’s average transaction fees have risen from approximately 20 cents to $1 over the past two years, inadvertently boosting its revenue.