Japanese OEMs are struggling to compete in China’s car market

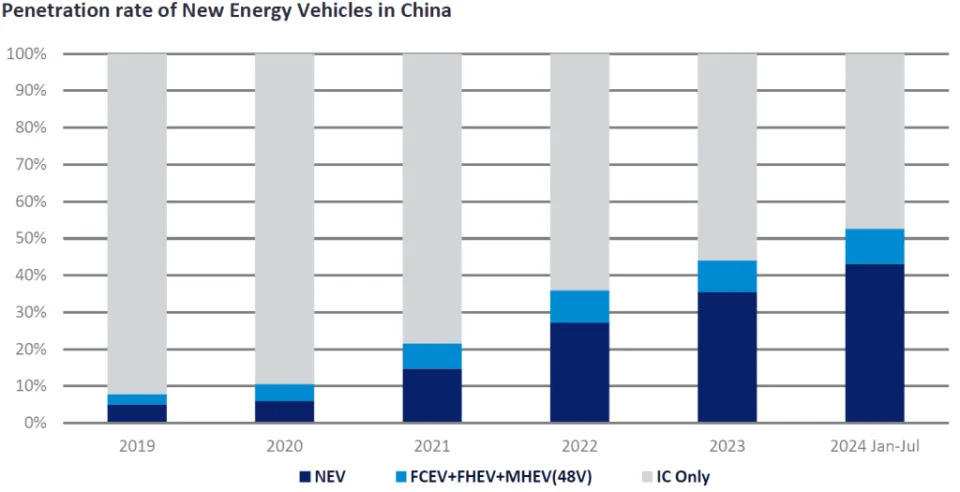

The world's largest automobile market, China, has undergone tremendous change in the past few years, in particular, the trend towards the New Energy Vehicle (NEV) transformation has been advancing rapidly. Different technical routes from major OEMs have flourished and some Chinese OEMs have seized the opportunity during this transformation wave to overtake foreign brands. China's domestic NEV sales successfully exceeded a penetration rate of 25% in 2022. In July of this year, they broke the 50% penetration barrier for the first time. Exports have also seen a historic breakthrough in volume terms. In 2023 Chinese OEMs surpassed Japan with exports of more than four million vehicles, becoming the world's largest automobile exporter. Despite China’s prosperous and fast-developing market, Japanese OEMs have lost ground in China.

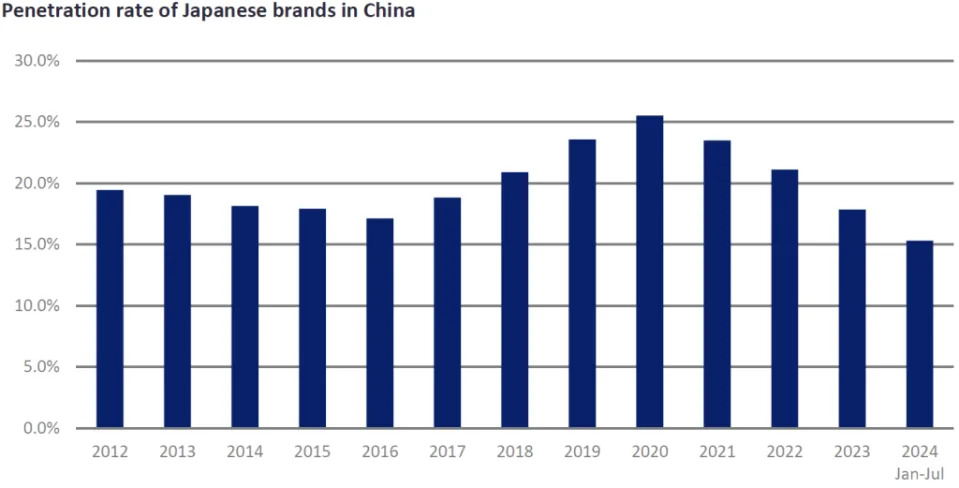

In 2020, sales of Japanese cars in the Chinese market exceeded the five million mark and the Passenger Vehicle (PV) market penetration rate exceeded 25%. This meant that for every four cars sold in the Chinese market, one was a Japanese brand car. However, in 2021, as the sales of NEVs jumped to more than three million units, exceeding the total of the previous three years and with YoY growth of over 150%, the entire industry saw an inflexion point. From 2021, the penetration rate of Japanese car brands entered a complete downward trend.

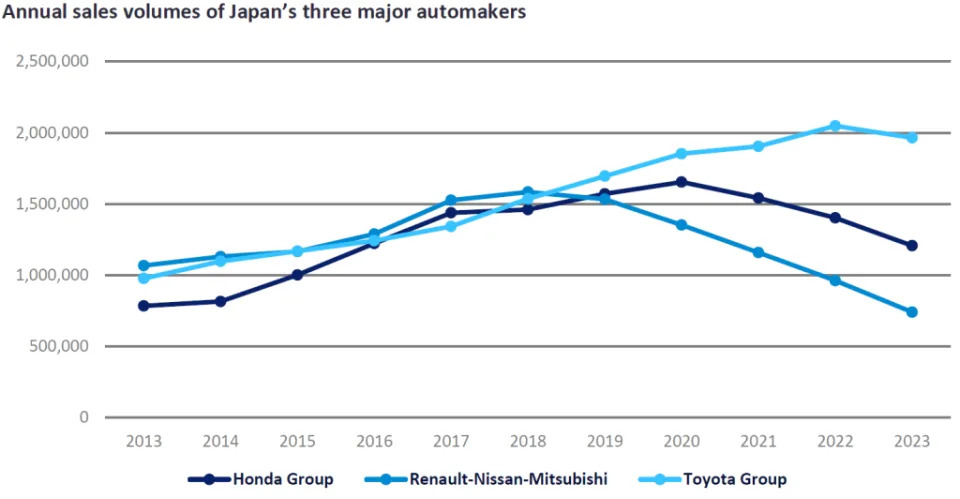

Subaru and Suzuki reached their sales peaks in China in 2013 and 2014 respectively, followed by a long downward decline. Suzuki announced in 2018 that it would withdraw most of its business from the Chinese market, causing its sales last year (2023) to be less than 5k vehicles. Subaru's sales have also dropped from nearly 60k units at their peak (2013) to less than 8k units in 2023. Mazda's sales exceeded 300k vehicles for the first time in 2017 and then declined at an average annual rate of -18% year-on-year (YoY), leading to sales in 2023 falling below 100k units for the first time, and the downward direction shows no signs of reversing. In addition to these representative Japanese brands, Japan’s three major automakers – Toyota Group, Honda Group and Renault-Nissan-Mitsubishi Group have not escaped the downward trend in China’s auto market.

The Acura brand, part of the Honda Group, announced in 2022 that it would withdraw from the Chinese market in 2023 due to sales falling far below expectations. Later, the Mitsubishi brand announced in October 2023 that it would also withdraw from the Chinese market due to a severe decline in sales. In addition, Infiniti sales in 2023 were only slightly more than 5k units, and it is also on the verge of exiting the Chinese market. The three major Japanese group brands – Nissan, Honda, and Toyota - are also experiencing varying degrees of decline. Nissan sold 0.66 mn units in 2023, a -19.4% YoY decline. Thanks to massive price reductions in 2024, Nissan sold more than 0.34 mn vehicles from January to July, with just a -2.5% YoY decline (hence barely maintaining the sales level seen in the same period last year). Honda sold over 1.2 mn units in 2023, but with a -13.7% YoY decline. Even with huge price reductions in 2024, Honda only sold 0.45 mn units from January to July cumulatively, a -24.5% YoY decline. Honda’s sales are likely to fall below one million units in 2024. In 2023 Toyota sold nearly 1.8 mn units, a -4.4% YoY decline. It sold over 0.78 mn units from January to July 2024, a -18.8% YoY cumulative decline.

All Japanese brands are finding it difficult to compete in China for several reasons, some of which are listed here. Japanese OEMs don’t appear to be proactive in the NEV transformation, displaying a certain degree of resistance. Moreover, the perception of Japanese vehicles in the Chinese market has traditionally been associated with fuel efficiency and high quality. However, the advantage they had in terms of fuel efficiency is quickly disappearing as NEVs become more prevalent. This shift became particularly pronounced following the launch of BYD's fifth-generation DM technology, which has effectively neutralised the fuel economy edge previously enjoyed by Japanese brands. Additionally, the collective fraud scandal involving several Japanese OEMs has tarnished their reputation for quality, and restoring a positive brand image is likely to be a lengthy process. Furthermore, when it comes to brand value, Japanese cars tend to have a weaker premium capability than their European and US counterparts. A competitive edge of Japanese vehicles – their affordability - is increasingly being encroached upon by competing domestic brands. Finally, Japanese automakers do not meet the growing demand for technologies such as autonomous driving and intelligent cockpits. The inability to meet these new expectations is a significant concern. Given these multifaceted challenges, the outlook for Japanese vehicles in the Chinese market is troubling.

Kevin Zeng, Light Vehicle Market Analyst, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

"Japanese OEMs are struggling to compete in China’s car market" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.