Should You Buy the 4 "Magnificent Seven" Stocks That Underperformed the S&P 500 and Nasdaq Composite in 2024?

The "Magnificent Seven" is a group of industry-leading technology-oriented companies that posted explosive gains in 2023. The seven stocks are Microsoft (NASDAQ: MSFT) , Apple (NASDAQ: AAPL) , Nvidia (NASDAQ: NVDA) , Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) , Amazon (NASDAQ: AMZN) , Meta Platforms (NASDAQ: META) , and Tesla (NASDAQ: TSLA) .

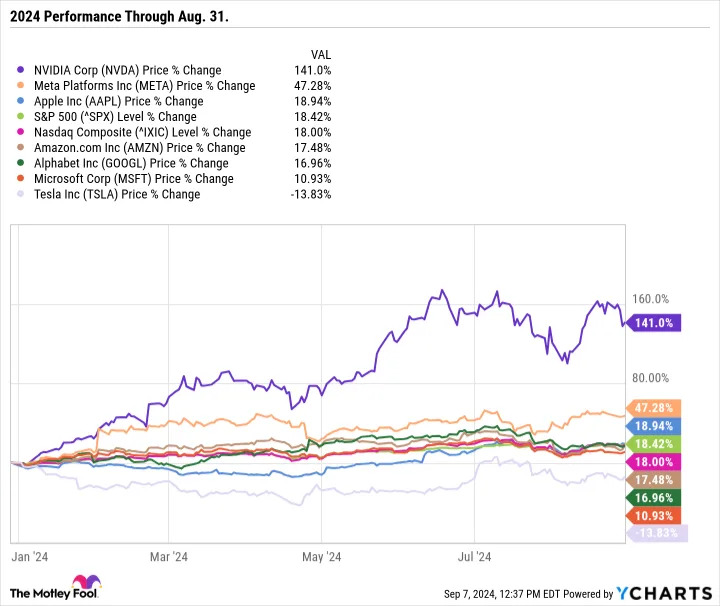

Nvidia, Meta Platforms, and Apple continue to outperform the S&P 500 and Nasdaq Composite in 2024. Despite reporting steep growth and upbeat guidance, Nvidia shares sold off on Aug. 29 in the wake of its quarterly print, but it was still up 141% year to date through the end of August.

Alphabet, Amazon, Microsoft, and Tesla, however, are all lagging the benchmark indexes so far in 2024. Here are the pros and cons of investing in each of these four companies, and my pick for the best one to buy now.

Alphabet isn't as cheap as it seems

Alphabet is trading like a value stock rather than a growth stock. It is the cheapest Magnificent Seven stock based on analysts' earnings estimates. It generates a ton of cash and has a diversified business that spans search, media, software, hardware, cloud infrastructure, and more.

Historically, Google has held its own against the rival tools that have tried to infiltrate the search industry. YouTube has blossomed into a coveted destination for advertisers. Google Cloud is one of the big three cloud infrastructure solutions, along with Amazon Web Services (AWS) and Microsoft Azure. Android is the operating system that underpins Samsung, Google Pixel, and other phones. But now more than ever, Alphabet's business model is under threat.

OpenAI's ChatGPT and SearchGPT have the potential to take a sizeable market share from Google Search. Meta Platforms' family of apps (Instagram, Facebook, Messenger, and What's App) offer advertisers alternatives to Google Ads or YouTube. Instagram is a mobile-first solution, which is an advantage if you believe a growing share of people's screen time will continue to shift from desktop to mobile. Growth in Meta's sales and margins indicate the business is thriving and outpacing Alphabet's growth.

If Alphabet's growth slows -- or if its top line starts to contract -- its stock at today's prices could start to look expensive.

Investors have waited a long time for this version of Amazon

AWS is Amazon's crown jewel and the undisputed leader in cloud infrastructure. For a while, Amazon was using that segment's profits to fund its growth efforts across its other business units. With so much pressure on AWS and growth slowing in 2022, it was unsurprising that the stock took a big hit.

Amazon has long been known for its aggressive spending and willingness to take risks. After all, how else could an online bookstore have grown to dominate e-commerce and cloud infrastructure?

But the tech giant has kicked into a new growth gear. It has turned around its e-commerce business, and its advertising arm is now generating sizable revenue and growing quickly.

Amazon is so big that it's difficult for everything to go right with the company at once. But it's truly firing on all cylinders now, which helps explain why the stock hit an all-time high earlier this year.

The share price surged by over 80% in 2023, so it's understandable that its growth rate cooled off this year. Amazon also relies heavily on stock-based compensation and continues to be more focused on revenue growth than profitability. Meta Platforms and Alphabet began paying dividends earlier this year, but Amazon still does not.

Amazon is a good choice for investors who are looking for a company that will pour profits back into the business rather than distribute some of them directly to shareholders. Because of its focus on sales growth, Amazon is expensive based on its forward P/E ratio, so it may not appeal to investors looking for a balance of growth and value.

Tesla is in "prove it" mode

Tesla is the only Magnificent Seven stock that is down in 2024. But it is far from the only automaker that's struggling.

The auto industry depends on consumer discretionary spending. When unemployment is low, wage growth is strong, and interest rates are low, consumers may be more inclined to make big-ticket purchases. However, they may delay purchases when borrowing costs are higher and household budgets are tighter.

Beyond the challenging macroeconomic backdrop, Tesla is also dealing with intensifying competition from legacy automakers and pure-play electric vehicle (EV) companies.

Perhaps the greatest threat is the market's slowing adoption of EVs. Companies like Toyota are having a great deal of success with hybrid options and are investing in new internal combustion engine designs that can run on fossil fuels and lower-emission fuels. EVs are no longer the only environmentally friendly solution, and some consumers may prefer hybrid models.

Tesla faces challenges, but it is still chock-full of growth potential. In October, it is expected to unveil updates to its autonomous driving fleet that could unlock a new revenue stream for the company.

With a market cap of $659 billion, Tesla remains a high-risk, high-potential reward company that should only be considered if you believe in its ability to monetize artificial intelligence (AI) and robotics.

Microsoft is a balanced buy

Microsoft stands out as a better buy than Alphabet, Amazon, or Tesla, and I don't think it's particularly close.

While Nvidia and Apple are considering investing in OpenAI, Microsoft already has a long-standing relationship with the company. Microsoft directly monetizes generative AI across its business segments through its Copilot tools for the Microsoft 365 software suite, GitHub, Azure AI, and more.

Out of all the megacap tech stocks, Microsoft has arguably the clearest path toward monetizing AI while also benefiting from its established position across so many industries. It's a different investment thesis than Nvidia, which could see the wheels fall off if there's a downturn in the cycle or if its competitors start taking significant market share in AI chips.

Unlike many other megacap companies, Microsoft repurchases more than enough of its stock to offset the impact of stock-based compensation on its outstanding share count. This not only prevents dilution, but it also leads to a lower share count and higher earnings per share. Microsoft also has a history of steadily growing its dividend, and it has made sizable annual raises to its payout for several years. Over the last 12 years, its payout has tripled.

To top it all off, Microsoft trades at a forward P/E ratio of 31.4, which is reasonable for a dominant high-margin business that is growing at an impressive rate. It also has more cash, cash equivalents, and marketable securities than long-term debt on its balance sheet.

When it comes to a long-term investment you can count on, Microsoft checks all the boxes and now would be a great time to consider picking up a few shares.

Before you buy stock in Microsoft, consider this: