3 Value Stocks to Buy as Berkshire Hathaway Hits an All-Time High on Warren Buffett's Birthday

Berkshire Hathaway 's (NYSE: BRK.A) (NYSE: BRK.B) stock price hit an all-time high on Aug. 30 -- Warren Buffett's 94th birthday -- before proceeding to rise even higher on Sept. 3 despite a 2.1% sell-off in the S&P 500 . The shares of the giant conglomerate are now up more than 27% year to date, outperforming both the S&P 500 and Nasdaq Composite by a wide margin.

Its portfolio managers have been on something of a selling spree lately -- making a large reduction in its Apple stake earlier this year and trimming its Bank of America position by 14.5% since mid-July.

However, Berkshire has maintained a sizable holding in oil and natural gas exploration and production company Occidental Petroleum (NYSE: OXY) , owns American Express , Visa , and Mastercard (NYSE: MA) , and initiated a position in Ulta Beauty (NASDAQ: ULTA) earlier this summer.

Here's why Occidental Petroleum, Mastercard, and Ulta stand out as three top value stocks to buy now.

Oxy can rake in the cash even at mediocre oil prices

Berkshire Hathaway owns 27.3% of Occidental Petroleum -- commonly referred to as Oxy. That stake, Berkshire's sixth-largest public equity holding, is worth more than $14 billion. But Oxy hasn't been a very good investment of late. The stock is hovering around a 52-week low.

Oil prices affect the fortunes of the entire oil and natural gas value chain, but especially exploration and production companies like Oxy that build their businesses around selling hydrocarbons for more than it costs to get those resources out of the ground. Unfortunately for Oxy and its peers, the price of West Texas Intermediate (WTI) crude oil -- the U.S. benchmark -- just fell below $70 a barrel to its lowest level so far this year.

Although Oxy can break even at a much lower oil price, $70 is significant because Oxy has based some of its key decisions around the assumption that prices will be at or above that level. In its fourth-quarter 2023 investor presentation, it used that threshold to predict year-one free cash flow (FCF) from its $12 billion acquisition of CrownRock. The lower the oil price, the lower the FCF, and the worse the acquisition will look -- at least in the short term. The good news is that CrownRock has plenty of acreage where the estimated breakeven levels are below $60 per barrel for WTI.

Oxy has also done an excellent job improving the health of its balance sheet by paying down debt. It's also aggressively investing in carbon capture and storage projects that could have long-term benefits for the company, both from an ESG (environmental, social, and governance) perspective and as a potential revenue stream in the form of carbon credits.

Oxy today trades at a dirt-cheap price-to-earnings (P/E) ratio of 13.5 and a price-to-FCF ratio of 13 -- meaning its earnings and FCF could fall and the stock would still be cheap. Now is a great time to scoop up shares of Berkshire's top energy company on sale.

Mastercard has a powerful moat

Credit card companies have proven to be phenomenal long-term investments. Mastercard and its closest peer, Visa, now have a combined market cap of nearly $1 trillion. And yet, they aren't necessarily overvalued.

Mastercard trades now at a forward P/E ratio of 33.3. That's higher than the S&P 500's trailing P/E ratio of 28.8, so even if Mastercard generates the earnings analysts expect over the next 12 months, it will still be more expensive than the S&P 500. With Mastercard, though, the value isn't just in the earnings, but the quality of the company and its growth trajectory.

Mastercard is an incredibly efficient business, with a 58.6% operating margin. It also has just $8.2 billion in total net long-term debt on its balance sheet, which is very small for a company of its size. Few companies in the S&P 500 can compete with Mastercard's profitability and financial health.

It also benefits from a huge network effect. Mastercard and Visa process the majority of credit card transactions in the U.S., and both are growing internationally. Fees are collected on both the number of transactions and the payment volume of total transactions. The more Mastercard debit and credit cards are in circulation, and the greater the partnerships with financial institutions like banks and credit unions, the more useful the network becomes to all participants, and the more incentive other customers and businesses have to join it.

Mastercard is expanding its value-added services business as consumers and merchants seek fraud prevention tools, better analytics, and cybersecurity solutions. This segment grew faster than Mastercard's core business last quarter.

Add it all up, and Mastercard stands out as a quality company that can continue delivering strong returns for investors.

Ulta is a catch-all way to play a recovery in cosmetics spending

Ulta is a new addition to Berkshire's portfolio. Although the position is valued at about a quarter-billion dollars -- much less than its other holdings -- Berkshire Hathaway now owns 1.5% of the retailer.

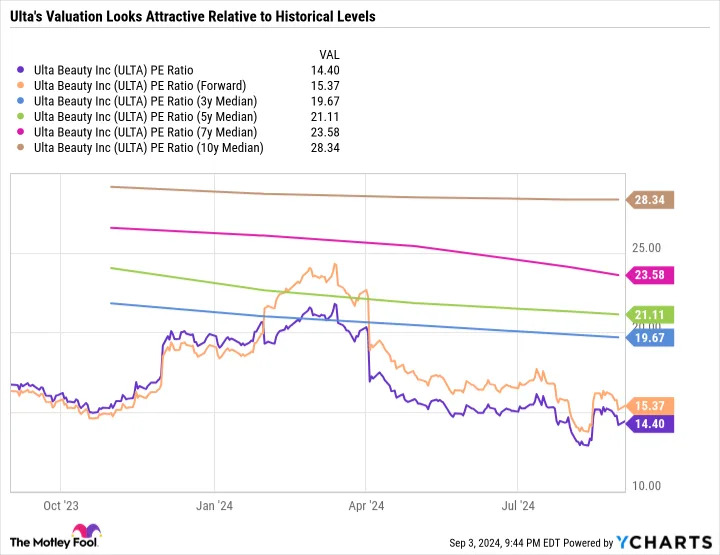

Ulta checks a lot of the boxes that Buffett and his team look for when searching for quality value stocks. The stock's valuation is significantly below historical median levels.

As you can see, Ulta's forward P/E ratio is above its current P/E -- meaning that analysts expect earnings to shrink in the next 12 months. There's no sugarcoating that Ulta's second-quarter 2024 earnings call was bleak, with management cutting the outlook for the second time this year. Competition and weak consumer spending were the headline concerns. But taking a step back, a slowdown in Ulta's growth is completely understandable.

The cosmetic industry boomed in recent years. And consumer trends toward more value-focused products -- like those sold by e.l.f. Beauty -- and away from premium-priced products like those sold by Estee Lauder or L'Oreal means lower margins and fewer reasons for customers to shop in its stores, try new products, or use Ulta's salon services.

That all adds up to a sluggish near-term outlook for the retailer. However, for investors with the patience to hold on as they wait for the industry to turn around, Ulta's dirt-cheap valuation and market position make it worth considering now.

Before you buy stock in Occidental Petroleum, consider this: