Treasuries inch lower as traders question pace of Fed rate cuts

(Bloomberg) — Treasuries fell at the start of the week with traders looking ahead to US inflation data for further clues on whether the Federal Reserve will deliver a jumbo interest-rate cut this year.

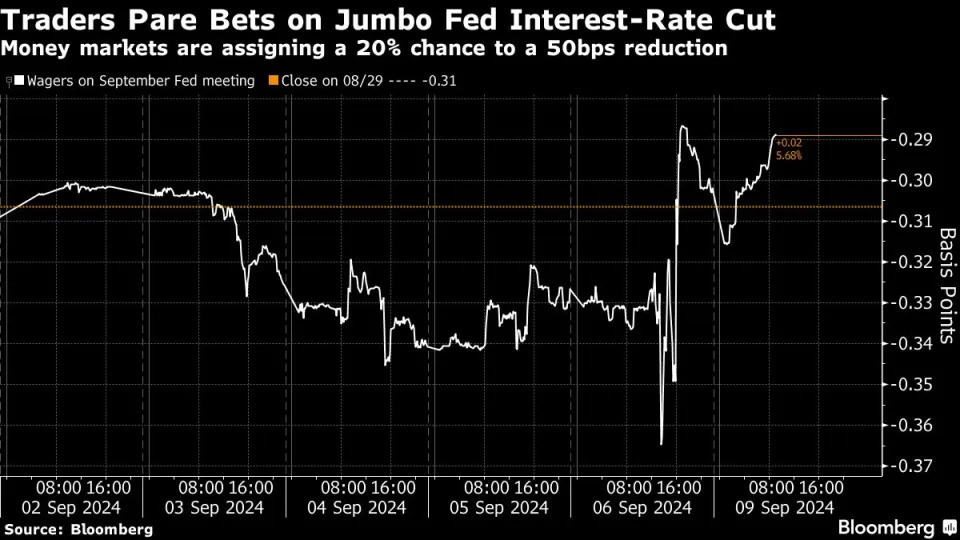

Yields on two-year notes ( 2YY=F ) — among the most sensitive to changes in the outlook for interest rates — rose as much as five basis points to 3.70%, while those on 10-year bonds climbed four basis points to 3.75%. The chance of a half-point rate reduction at the Fed upcoming September meeting was pared to 20% from 30% last week, according to swaps.

While US labor market data Friday pointed to a cooling economy, comments from policymakers that followed fell short of painting a clear case for a big rate cut. Fed governor Christopher Waller echoed Chair Jerome Powell’s comments that it’s time to start cutting rates, but stressed the size and pace of easing will depend on upcoming economic data.

“The US August CPI report will help shape the magnitude of the Fed’s September rate cut decision,” said Elias Haddad, a senior markets strategist at Brown Brothers Harriman. “Higher than expected US inflation can reduce the probability of a jumbo Fed funds rate cut.”

The US consumer price index due on Wednesday likely rose 2.6% in August from a year earlier, according to a Bloomberg survey. That would be the lowest inflation rate in over three years.

Alongside the inflation report, attention is turning to the US presidential debate between Kamala Harris and Donald Trump on Tuesday, after president Joe Biden’s calamitous performance saw Trump rise in popularity offering support to the dollar. The Bloomberg Dollar Index inched up 0.2% on Monday, with the greenback gaining against most Group-of-10 peers.

“The August US jobs report has failed to resolve the debate over whether the Federal Reserve will cut rates by 25bps or 50bps on Sept. 18,” said Chris Turner, head of foreign exchange strategy at ING Bank NV. “Potentially one of the biggest market movers this week is tomorrow night’s US presidential debate.”