Crypto for Advisors: Bitcoin and Gold, Stores of Value

In today’s issue, Ilan Solot from Marex Solutions examines gold and bitcoin’s role as stores of value assets and how this role changes over time.

Then, DJ Windle from Windle Wealth explains how bitcoin and gold are both stores of value and the differences between each asset in Ask an Expert.

- Sarah Morton

You’re reading Crypto for Advisors , CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

The Weakening Store of Value Argument for Gold and Bitcoin

Summary: The approval of the bitcoin and Ethereum ETFs could represent a similar change in market to what central banks caused in gold markets post-2022 – a new factor that, at least temporarily, overwhelms traditional narratives, including the “store of value” concept.

The August market sell-off frustrated proponents of bitcoin’s store-of-value properties. After all, crypto was down badly while gold rallied during the week. To add insult to injury, bitcoin underperformed when markets bounced back.

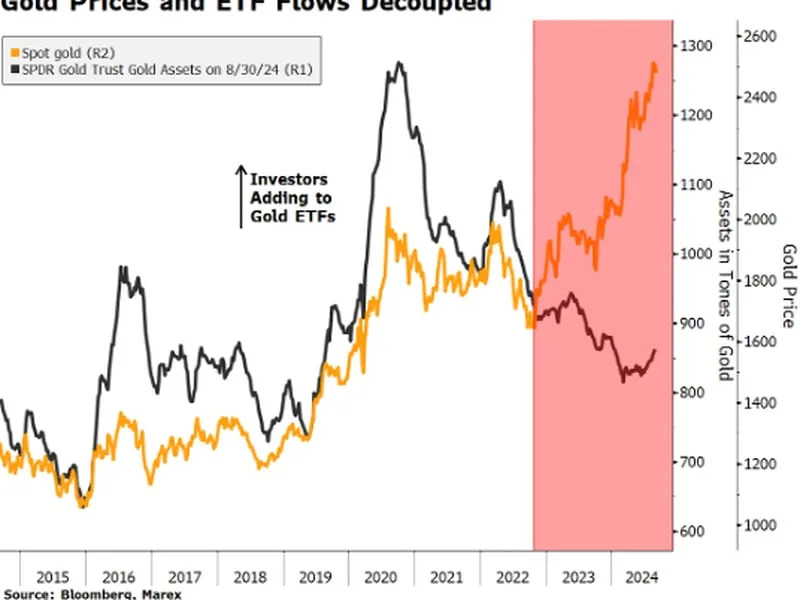

However, despite the price appreciation, gold might also be losing some of its store-of-value properties. Price and narrative decoupled around 2022. Traditional investors continued following the decade-long pattern of selling gold as real yields and inflation expectations rose ahead of central bank tightening. The problem is that this time, gold went the other way.

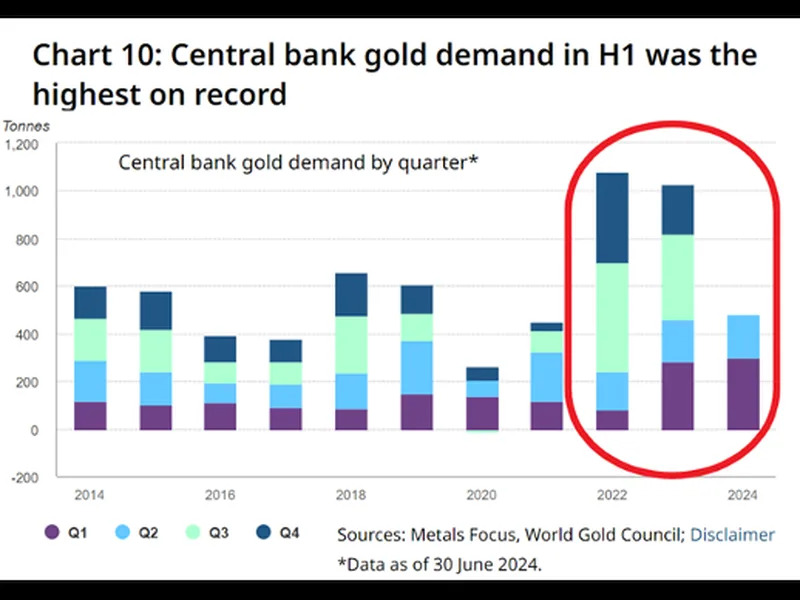

Why has the gold price not responded to its store of value macro drivers? A change in market structure: Asian central banks dramatically increased their gold purchases around the time of Russia’s invasion of Ukraine and the seizing of its FX reserves. We might even say that these governments are following their own competing narrative.

Russian, Indian and Chinese policymakers couldn’t care less about gold as a “store of value” from the perspective of a Western investor. Fed policy, inflation expectations and libertarian principles will likely never influence the cycle of accumulation – and eventual use – of their gold reserves.

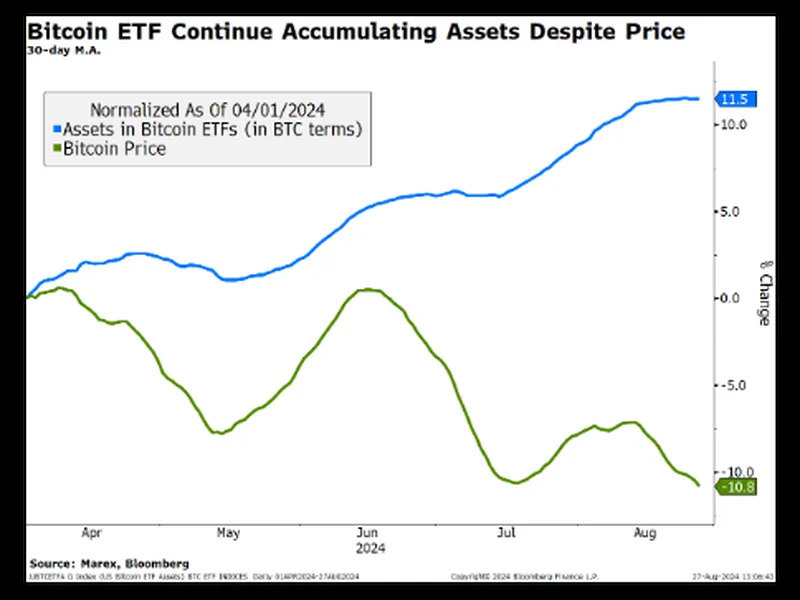

Over time, the approval of crypto ETFs in the U.S. could represent a similar disruption in market structure as the one seen in gold. It could shift the narratives around BTC (store of value) and ETH (crypto tech play) closer to a traditional investment asset. In other words, ETF investors may be following different narratives and demand functions (say, portfolio rebalancing or disposable income) to crypto native investors, the same way as Asian central banks buy gold for different reasons than traditional investors.

Indeed, the recent ETF and bitcoin price data seem to support this conclusion. ETFs continued to attract inflows despite the wild price fluctuations and shift in narratives around bitcoin over the last few months. Please note that this is a very short timeframe, so any extrapolation should be taken with a grain of salt. But so far, it seems directionally right. In fact, the impact of Grayscale outflows in BTC and ETH gives us a glimpse of how cycle-agnostic ETF flows can impact price.

Does this mean that gold and bitcoin are no longer stores of value assets? Not necessarily. Narratives can coexist, shift, weaken and take turns leading prices. However, the presence of new, large and different investor sets in both these markets is likely to dilute original narratives and change how prices react to macro events.

- Ilan Solot, senior global market strategist, Marex Solutions

Ask an Expert

Q. What is a store of value?

A. A store of value is an asset that can be saved, retrieved, and exchanged in the future without significantly losing its purchasing power. Assets like gold, real estate, or stable currencies have traditionally served this purpose because they tend to retain value over time and during market downturns. This does not necessarily mean they cannot be volatile in the short term. The core idea is to provide security against inflation, currency devaluation and economic instability over time, allowing investors to preserve wealth across generations.

Q. How is bitcoin similar to gold?

A. Bitcoin and gold share several characteristics that make them appealing as stores of value. Both are finite in supply—gold by its natural scarcity and bitcoin by its capped supply of 21 million coins. Neither is controlled by any central government, which makes them attractive alternatives to traditional fiat currencies. Both bitcoin and gold, however, have different types of security risks that need to be addressed when investing in them. In times of economic uncertainty or inflation, investors often flock to these assets to preserve value, viewing them as a hedge against market volatility and loss of purchasing power.

Q. How is bitcoin different from gold?

A. Bitcoin brings new attributes to the table that gold lacks. As a digital asset, bitcoin can be transferred globally in minutes, unlike gold, which is cumbersome and costly to move. Bitcoin's underlying blockchain technology ensures transparency, allowing for verifiable ownership and transactions. Additionally, Bitcoin is programmable, meaning it can be integrated into digital applications like smart contracts and DeFi platforms, making it highly versatile in the modern financial ecosystem. These qualities make bitcoin an innovative option beyond traditional uses of gold.

- DJ Windle, founder and portfolio manager, Windle Wealth