Robinhood Trading Platform to Pay $3.9M for Crypto-Withdrawal Failure

In a settlement with the California Department of Justice over crypto withdrawals,

Robinhood Markets, Inc.

’s HOOD cryptocurrency platform will pay $3.9 million. Per the claims, HOOD prevented its customers from withdrawing cryptocurrency from their accounts between 2018 and 2022.

Per California’s attorney general Rob Bonta, Robinhood violated California law as it failed to deliver cryptocurrencies that its customers bought, because of which, customers were unable to withdraw their assets, forcing them to sell the assets to exit the platform.

Bonta also said that Robinhood misled its customers about where their crypto assets were held. Also, the trading platform falsely advertised that it would connect customers to multiple trading venues so that they would get competitive prices.

As part of the settlement, Robinhood’s crypto platform is required to allow customers withdraw crypto assets to their own wallets, and honor its representations about its trading and order handling practices.

Bonta said that the settlement “should send a strong message: whether you're a brick-and-mortar store or a cryptocurrency company, you must adhere to California's consumer and investor protection laws.”

While Robinhood did not admit or deny the wrongdoing, its general counsel, Lucas Moskowitz, stated, “We are pleased to put this matter behind us. The settlement fully resolves the Attorney General's concerns related to historical practices, and we look forward to continuing to make crypto more accessible and affordable to everyone.”

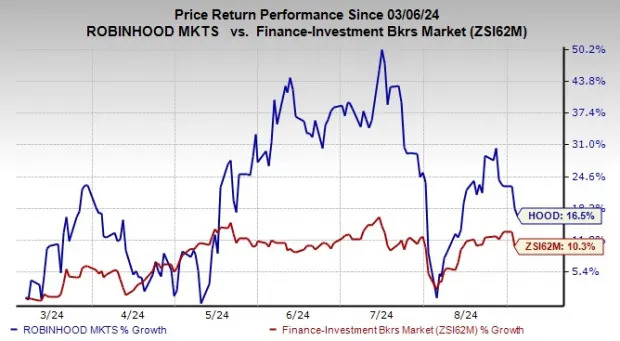

Over the past six months, HOOD shares have gained 16.5% compared with the industry’s 10.3% growth.

Currently, Robinhood carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Financial Misconduct by Other Firms

Recently, an order was issued by the Commodity Futures Trading Commission (“CFTC”) for

The Bank of New York Mellon Corporation

BK to pay a civil penalty of $5 million for failing to report millions of swap transactions to a registered swap data repository in violation of a prior CFTC order.

BNY Mellon also failed to supervise its swap dealer business as required by the Commodity Exchange Act and CFTC regulations.

In addition to the monetary penalty, BNY Mellon agreed to retain an independent compliance consultant to review and provide advice regarding its compliance program.

Per the CFTC, between 2018 and 2023, BK repeatedly failed to correctly report at least five million swap transactions and supervise its swap dealer business.

Likewise, the CFTC has asked banks like

JPMorgan

JPM and

Citigroup

C for non-disclosure agreements in their swaps and clearing businesses. Also, the financial regulator has sought employment and customer agreements from JPM and C in those businesses.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research