Veeva Continues to Show a Combination of Growth and Resilience. Time to Buy the Stock?

As a leading software company catering to the healthcare sector, Veeva Systems (NYSE: VEEV) has provided solid growth while operating in a defensive industry. The stock has had a good year, up over 10%, but it has trailed the market over the past five years even as management takes the business in a new direction.

Let's dive into the company's most recent results and see if now is the time to buy the stock.

Strong revenue growth

For its fiscal second quarter, ended in July, Veeva's revenue increased 15% to $676.2 million, which was well above the $666 million to $669 million it had expected. More importantly, subscription revenue jumped 19% to $561.3 million, above its $554 million forecast. Service revenue fell 4% to $114.9 million. Subscription revenue is high-margin and recurring, while service revenue is lower-margin and is less predictable.

Commercial solutions subscription revenue rose 12% to $271.8 million, while service revenue for the segment dropped 5% to $45.1 million. This segment provides solutions for life science companies to help them commercialize their products and was originally built on top of Saleforce 's platform. However, it is moving away from that platform -- its new CRM Vault platform became widely available in April and it already has customers live on it. It won 14 new deals in the quarter for the offering. The company said so far the transition is going well, and there are several large customer migrations scheduled for next year.

R&D solutions revenue, meanwhile, soared 27% to $289.5 million. Service revenue for the segment edged lower by 3%, coming in at $69.8 million. This segment provides software solutions that help life science companies with the development of drugs and medical devices.

Adjusted earnings per share (EPS) came in at $1.62, a 34% increase versus a year ago. Normalized billings, meanwhile, were up 11% year over year to $631 million. The company also generated $92.8 million in operating cash flow for the quarter and $856.4 million for the first six months. Veeva typically generates the bulk of its cash flow in fiscal Q1. It ended the quarter with more than $4.9 billion in cash and short-term investments and zero debt.

Veeva expects fiscal third-quarter revenue to come in between $682 million and $685 million. Subscription revenue is projected to be around $571 million. Adjusted EPS is forecast to be between $1.57 to $1.58.

For the full year, management has guided for revenue to range between $2.704 to $27.1 billion with subscription revenue of approximately $2.257 billion. Veeva is looking for adjusted EPS to be around $6.22. Those numbers are up slightly from its prior outlook.

|

Metric |

Old Guidance |

New Guidance |

|---|---|---|

|

Revenue (in billions) |

$2.7 to $27.1 |

$2.704 to $27.1 |

|

Subscription revenue (in billions) |

$2.245 |

$2.257 |

|

Adjusted earnings per share |

$6.16 |

$6.22 |

Data source: Veeva Systems.

The company said the increase in guidance stemmed from strong execution, noting that there has been no change to the macro environment.

Viva la Veeva

The biggest issue surrounding Veeva is the transition of its commercial solutions customers to its Vault platform. The migration should help the company's already solid gross margin (over 85% for its subscription businesses) as Veeva will no longer have to pay Salesforce a licensing fee. However, the company's decision to not renew its agreement with Salesforce when it expires in September 2025 will also put it in competition with the software giant.

For its part, Salesforce recently got the licensing rights back from former Veeva competitor IQVIA and will try to build on top of that product. Veeva, meanwhile, said that it plans to have its top 20 pharmaceutical customers migrated over to its Vault platform by the end of next year and questioned how long it would take Salesforce to come out with a competitive product.

Customers already use the Vault platform with Veeva's fast-growing R&D solution and these platforms are generally very sticky, so I don't think Salesforce will be able to steal back many Veeva customers although it is a risk. Meanwhile, the company has seen growth for its commercial solutions product accelerate the past two quarters.

At the same time, its R&D solutions platform continues to be the company's biggest growth driver. It also will have the opportunity to expand into adjacent industries when its Salesforce agreement officially expires next fall.

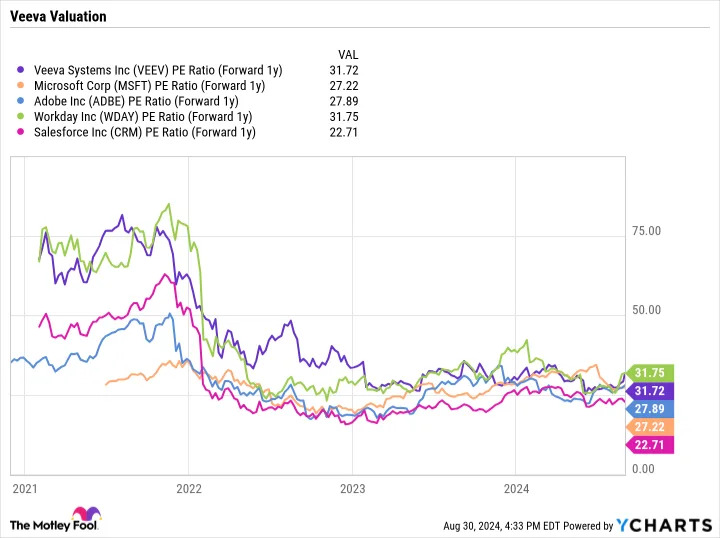

Trading at a forward P/E of under 32 next year's analyst estimates, the stock is valued similar to other more mature software-as-a-service (SaaS) names.

However, the company has a solid gross margin expansion story in front of it starting the fall of 2025, and it also caters to one of the most stable and defensive industries out there. Given that, I would be a buyer of the stock at current levels.

Before you buy stock in Veeva Systems, consider this: