2 Cathie Wood Stocks That Are Top Buys for Long-Term Investors

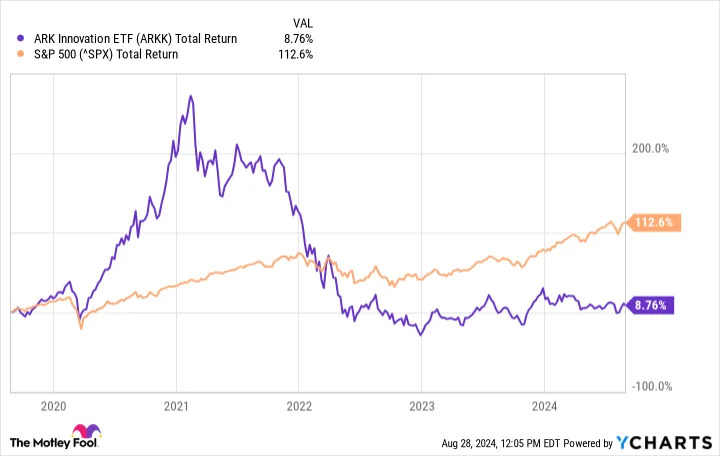

Cathie Wood has gained prominence as an investor focusing on disruptive technologies. Her flagship fund, the ARK Innovation ETF (NYSEMKT: ARKK) , is known for its volatility and relatively high expense ratio of 0.75%. Despite Wood's reputation as a skilled stock picker, the fund has severely underperformed the S&P 500 over the past five years (see graph below). Nevertheless, the ARK Innovation ETF can be a valuable source of growth stock ideas for investors with a long-term perspective.

Among the growth stocks in Wood's portfolio, two stand out as potentially attractive investments: Roblox (NYSE: RBLX) and Palantir Technologies (NYSE: PLTR) . While these emerging innovation companies carry inherent risks, they may offer significant growth potential for investors willing to hold positions for 10 to 20 years. Here's an analysis of why these two stocks might be worth adding to a long-term, well-diversified portfolio.

Roblox: Crafting a digital realm for sustainable growth

At the intersection of gaming and social interaction, Roblox has cultivated an innovative ecosystem where creativity flourishes and economic opportunities abound. The platform's revolutionary approach to user-generated content has catalyzed exponential growth, with its community swelling from 19.1 million daily active users in late 2019 to a whopping 65 million by mid-2023, fostering a self-reinforcing cycle of engagement and development.

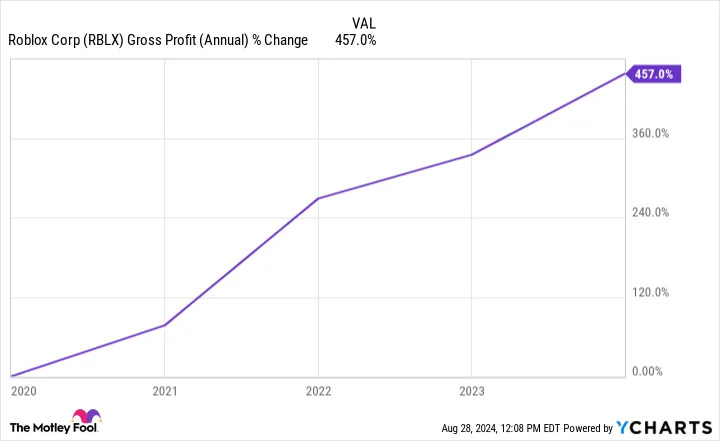

While profitability remains elusive, Roblox's financial trajectory shows promise. Its gross margins have soared to unprecedented heights over recent years as the company explores novel revenue channels, like immersive advertising experiences. By strategically targeting older demographics with higher disposable incomes, Roblox aims to unlock new avenues for monetization and pave the way for future financial success.

The company's strategic focus on nurturing its young user base positions it advantageously in the attention economy, with the potential for significant returns as these digital natives mature. This demographic evolution could serve as a powerful catalyst for Roblox's financial performance over the next 10 to 20 years, potentially transforming today's engaged players into tomorrow's lucrative customers.

Despite lagging the broader markets since its public debut, Roblox continues to garner optimism from financial analysts, who project robust top-line growth exceeding 19% for the coming two years. The company's distinctive market position, coupled with its demonstrated ability to evolve alongside user preferences, presents an enticing proposition for investors with the patience to embrace short-term market fluctuations in pursuit of long-term value creation.

Palantir: Building data-driven decision-making for the decades ahead

Palantir Technologies stands at the forefront of a long-term revolution in artificial intelligence (AI) and machine learning infrastructure. The company develops sophisticated platforms aimed at transforming how organizations harness data for strategic decision-making over extended periods. Palantir's flagship products, Gotham and Foundry, address complex data challenges that will likely become increasingly prevalent as information volumes grow exponentially in the coming years.

The company's strategic evolution toward modular solutions and usage-based pricing reflects a forward-thinking approach to market dynamics. This shift positions Palantir to capture a broader spectrum of clients over time, potentially leading to sustained growth as organizations gradually increase their reliance on AI-driven analytics. The long-term value proposition lies in Palantir's ability to grow alongside its clients, deepening relationships and expanding its footprint within organizations over years or even decades.

Palantir's dual focus on government and commercial sectors provides a foundation for long-term stability and growth. Government contracts offer a steady revenue base, while the commercial sector presents significant expansion opportunities. The company's impressive growth in the U.S. commercial segment hints at a broader, long-term trend of businesses increasingly adopting AI solutions to maintain competitiveness in a data-driven world.

As AI becomes more deeply integrated into business and governmental operations, Palantir's emphasis on security and its track record with sensitive data position it favorably for enduring success.

The company's expanding customer base and the increasing sophistication of its platforms suggest that Palantir is building a durable competitive advantage. All things considered, Palantir's strategic positioning in the rapidly growing AI space presents an intriguing opportunity for investors with a multiyear or even multidecade investment horizon.

Before you buy stock in Roblox, consider this: