Want to Buy Home Depot Stock? Here's the Key Number Every Investor Should Follow

Some investors are looking at buying The Home Depot (NYSE: HD) stock as a play on the likelihood of a decline in interest rates boosting the housing market and a corresponding increase in spending on home improvement. It's an intriguing idea, but skeptics suggest the housing market recovery may prove sluggish, even in a lower interest-rate environment.

For anyone following the home improvement retail giant, here's one key number you should keep an eye on.

Transaction volumes, not comparable sales growth

In my view, Home Depot will indeed enjoy the benefits of a housing recovery, but it will take time to unfold. The key metric for investors to follow is transaction volume growth, rather than comparable sales growth.

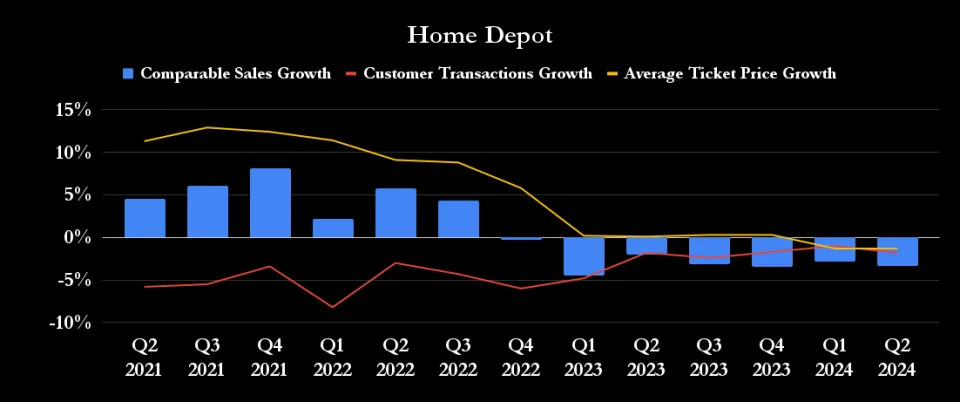

The two are obviously related, but investors should also consider the effect of average ticket size, not least because inflation-led price increases have helped offset declining transaction volumes. The chart of the growth in Home Depot's comparable sales, average ticket price, and transaction volume below shows these relationships.

A few points to note: First, year-over-year customer transaction growth turned negative in the second quarter of fiscal 2021, due to challenging comparisons with the COVID-19-related demand boom in 2020. Still, it's important to note that comparable sales growth was positive up until the fiscal 2023 first quarter, primarily due to increased pricing.

Second, when average ticket price growth flattened, Home Depot's comparable sales growth started to decline in line with ongoing transaction growth declines.

The key takeaway is the very same inflation that led to house price increases also flattened Home Depot's comparable sales growth at a time when transaction growth was negative.

But here's the thing: The Federal Reserve will only cut interest rates when inflation is tamed. That means overall price level growth in the economy will be curtailed, including things that Home Depot sells. That means Home Depot might not find it so easy to increase its average ticket price in a recovery. The key metric to follow is an improvement in transaction volume, which will likely flow into increased comparable sales growth as the recovery builds.

What it means for Home Depot investors

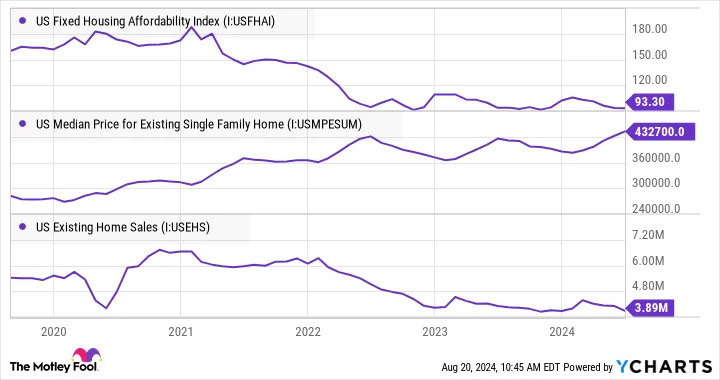

Lower interest rates help the housing market, without a doubt. They reduce monthly mortgage payments, create more economic growth, and provide a sense of job security that encourages home sales. The trend of existing home sales is usually the key number that guides end market conditions for the home improvement sector.

As you can see below, existing home sales started trending lower in 2021, just as existing home prices shot higher, reducing housing affordability. For reference, housing affordability refers to the income level of a typical family in order to qualify for a typical mortgage. Hence, a higher number means more affordability, and a lower number means less.

Simply put, in 2021, house prices rose, affordability declined, existing home sales declined, and ultimately (see chart above), Home Depot's transaction volume started declining. While it's easy to blame the housing slowdown on the Federal Reserve, readers should note that interest rates began to rise in the spring of 2022.

Why it could take time for Home Depot's transaction volume to increase significantly

If the key to rising transaction volume is existing home sales, it may be a while before the latter picks up meaningfully. The main reason is that housing affordability remains low. A cut in interest rates will help affordability, but as the chart above demonstrates, house prices have surged recently. If they start rising again after an interest rate cut, then affordability still suffers.

Another scenario is that house prices flatten or decline, but it's unusual to imagine falling house prices and an increase in Home Depot's transaction volume.

Where next for Home Depot?

A housing market recovery is likely, but it could be more sluggish than many realize. Home Depot is an excellent way to play a lower interest-rate environment, but watch its transaction volume growth as the critical marker of progress. As usual, the stock is best viewed with a long-term mindset, and investors will have to be patient.

Before you buy stock in Home Depot, consider this: