3 Reasons to Buy Enbridge Stock Like There's No Tomorrow

The big reason most income investors will want to buy Enbridge (NYSE: ENB) is its hefty dividend, which currently yields 6.9%. However, you really need to dig beneath that number to understand why this stock is so desirable to own. The list of pros includes the dividend (but for more than just the yield), the diversified underlying business, and the expansion the company has undertaken.

1. It boasts an attractive dividend yield

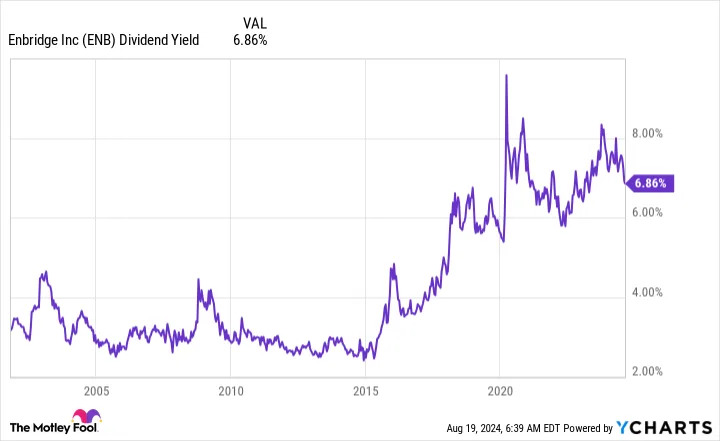

Enbridge's dividend yield of 6.9% compares quite favorably to the broader market, which on average is yielding a scant 1.2% or so, and also to the energy sector, where the average yield is roughly 3.1%. So, clearly, income investors will find Enbridge's yield attractive on both an absolute level and relative to other options. But there's one more factor to consider here: The yield is also near the high end of its historical range. In other words, Enbridge's dividend looks attractive relative to its own history as well.

Then there's the fact that Enbridge has increased its payout annually for 29 consecutive years. Further, its distributable cash flow payout ratio is well within management's target range of 60% to 70% The balance sheet is also healthy: Leverage is well within management's target range of 4.5 to 5 times debt to EBITDA (earnings before interest, taxes, deprecation, and amortization). Simply put, the dividend is on a strong financial foundation.

2. Enbridge is a toll taker

What's equally interesting here is Enbridge's core business model. Throughout its business, the company focuses on generating reliable cash flows from fees, regulated assets, and contracts. This list is important to examine, however, because it speaks to the very different segments contained within the portfolio.

The core assets of the business, accounting for around 75% of EBITDA, are oil and natural gas pipelines. These are toll-taker assets -- customers pay for the use of the vital energy infrastructure that Enbridge owns. Another 22% or so of EBITDA is derived from its natural gas utilities, which are regulated assets producing reliable cash flows. The remaining EBITDA comes from its renewable power assets, where revenues are driven by long-term contracts.

There are a couple of key takeaways here. First, every business that Enbridge owns is a toll taker that produces reliable cash flows to support the dividend. Second, Enbridge is pretty diversified compared to other midstream players.

3. Enbridge is shifting with the times

The diversification in the business is purposeful, but it's not just to create various income streams. You see, Enbridge's management is well aware that the world is shifting away from dirtier energy sources and toward cleaner ones. That is why it recently agreed to buy three natural gas utilities from Dominion Energy (NYSE: D) . This move will reduce Enbridge's exposure to oil from 57% of EBITDA to 50%.

While natural gas is still a hydrocarbon fuel, it is cleaner burning than oil and coal. Natural gas is expected to be a transition fuel that will be relied on as the world moves toward much greater use of renewable power, which is still a small piece of the overall energy pie. But Enbridge isn't ignoring clean energy; it has a small footprint in that space as well, providing around 3% of its EBITDA. The goal isn't to remake the company, it is to provide the world with the power it requires. Management is doing just that as it slowly shifts toward cleaner options.

Attractive all around

If you are looking for a high-yield energy stock that you can count on for the long term, Enbridge is one that you should probably be looking to buy today. And if you do decide to buy it because of its high yield, attractive business, and purposefully shifting asset portfolio, you might want to buy a lot of it. The stock is still attractively priced today, but that might not be the case tomorrow as more and more investors figure out just how attractive a dividend stock it has become.

Before you buy stock in Enbridge, consider this: