Warren Buffett's Berkshire Hathaway Sells Its Snowflake Stock. Don't Follow.

Warren Buffett and his team at Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) are some of the best investors ever. They are known for their value investing philosophy, which is why it may have surprised some people when they took a position in a high-flying growth company like Snowflake (NYSE: SNOW) when it debuted on the public markets in late 2020.

However, as of June 30, Berkshire no longer owns Snowflake shares, as it sold them in the second quarter. I think Berkshire exited its position in Snowflake at potentially the worst possible time. But for Buffett & Co., it may have been a good move.

Snowflake wasn't Berkshire's average investment

Warren Buffett isn't the only investor with sway at Berkshire Hathaway. Todd Combs and Ted Weschler also get to make decisions, and they are known to be more growth-oriented than Buffett, although value investing is at the heart of what they do. This brings up an important caveat in the value investing philosophy: Even growth companies can be considered value stocks if the right conditions persist. Take Apple , for example. When Berkshire first bought Apple shares, it was still growing but was also dirt cheap.

But it would seem the crew over at Berkshire has lost faith in Snowflake. Berkshire bought Snowflake stock at a pre-IPO price of $120 per share, which was a fantastic deal since the stock began trading at around $245 that day. Although Snowflake stock traded for an average of $148 in Q2, there were two ranges: before and after Q1 earnings were released on May 22. If Berkshire sold before earnings, it likely got around $155 per share; if it sold after, it was probably around $125.

So, what's up with the large price difference?

About a month after the conclusion of Snowflake's 2024 fiscal year (ending Jan. 31), its longtime CEO, Frank Slootman, retired. Sridhar Ramaswamy, who had been leading Snowflake’s AI strategy , replaced him, and his first quarter didn't go well. The stock dropped 5% the day after the May 22 quarterly report and is now down about 20% since the closing price right before the report.

Snowflake's growth is starting to slow, and the company is nowhere near profitability. It also had a data breach issue that caused many investors to lose faith.

With a cloudy path to profitability, Berkshire perhaps decided enough was enough and exited while it was still up on the investment. But I think this was a premature move.

Snowflake still has a massive catalyst yet to be realized

Snowflake provides customers with software to manage data in a cloud environment. This product saw widespread use and growth over the past few years, and with artificial intelligence (AI) starting to pick up steam, it could become an even bigger company. If every company wants to have its own AI model tailored to its business, it'll need lots of data to train it. This directly benefits Snowflake, but this demand ramp may still be a year or two off.

Berkshire isn't the only group that has lost faith in Snowflake; many more have headed for the exits, sending the price down. As a result, Snowflake's valuation is at an all-time low from a price-to-sales (P/S) standpoint.

At 14 times sales, Snowflake stock could almost be considered a value play again (I'm half-joking here!). Although 14 times sales is still very expensive for most companies, the potential for Snowflake is high due to its software business.

It's not uncommon for businesses like Snowflake to achieve a profit margin in the 20% to 30% range. However, Snowflake is currently nowhere near that, with a negative-38% profit margin in Q1. This is because Snowflake is heavily investing in growth due to the massive opportunity in front of it.

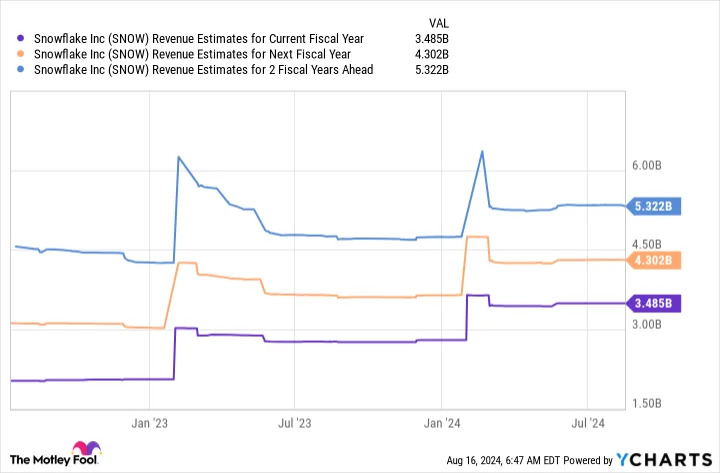

Analysts see huge growth ahead for Snowflake, with around $5.3 billion in expected revenue in FY 2027 (ending January 2027).

A lot can happen over the next two and a half years, and if Snowflake hits those revenue targets and achieves a 20% profit margin, it would produce around $1.06 billion in profits. Today's valuation would value the stock at around 40 times those earnings, which is fairly average for a mature software stock.

There are a lot of "ifs" in those projections, but investors shouldn't slam the door shut on Snowflake yet. Right now is perhaps the worst possible time to sell Snowflake shares, and I think investors should hold on to what they've got (or consider buying more), as Snowflake's brighter days are still ahead of it.

Before you buy stock in Snowflake, consider this: