This Magnificent Growth Stock Just Made a Big Move, but Should You Buy It?

Shares of The Trade Desk (NASDAQ: TTD) shot up more than 12% in a single session after the company released its second-quarter 2024 results on Aug. 8. The big move wasn't surprising as the programmatic advertising provider delivered stronger-than-expected growth.

The Trade Desk's latest pop means the stock is now up 36% so far this year. Moreover, it is trading at a steep valuation right now. Does this mean it is too late for investors to buy this growth stock ? Or can they still consider adding The Trade Desk to their portfolios in anticipation of more upside? Let's find out.

The Trade Desk is stepping on the gas

The Trade Desk reported Q2 revenue of $585 million, a jump of 26% from the same quarter last year when its revenue jumped 23% year over year, indicating that the company's growth is accelerating. Meanwhile, its adjusted earnings increased 39% on a year-over-year basis to $0.39 per share. Wall Street would have settled for earnings of $0.36 per share on revenue of $578 million.

However, the company cleared those estimates thanks to an acceleration in connected television (CTV) advertising. The Trade Desk's data-driven, programmatic advertising platform allows advertisers to purchase ad inventory in real time and serve ads across multiple channels, such as CTV, online video, mobile, and e-commerce channels, among others.

The company is operating in a fast-growing market. The global programmatic advertising market is expected to generate $595 billion in revenue this year, a number that's expected to balloon to $779 billion in 2028. More importantly, The Trade Desk has been integrating artificial intelligence (AI) into its platform to enable better audience targeting for advertisers and drive greater returns on ad dollars spent.

On its latest earnings conference call , CEO Jeff Green pointed out that customers who have adopted The Trade Desk's AI-enabled advertising platform, Kokai, have witnessed a 70% jump in reach, along with a 27% improvement in cost per acquisition. So, it is not surprising that The Trade Desk grew at an improved pace last quarter compared to the same period last year.

The good part is that The Trade Desk believes that its total addressable market could eventually be worth $1 trillion. As such, it won't be surprising to see the company sustain its healthy levels of growth in the long run and grow at a faster pace than the market's expectations. For instance, The Trade Desk is expecting the revenue for its quarter ending in September to be at least $618 million. That would be an increase of 25% from the year-ago period and is well above the consensus expectation of $605 million.

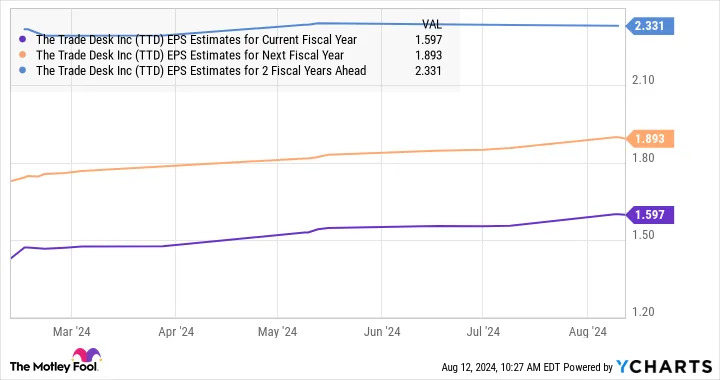

However, there is a good chance of The Trade Desk beating its own expectations thanks to the impressive traction it is gaining in the programmatic advertising space. Not surprisingly, analysts have boosted their earnings growth expectations from the company.

But is the stock worth buying now?

The Trade Desk's solid surge in 2024 means it is now trading at an expensive 23 times sales. That's significantly higher than the U.S. technology sector's average of 7.3. Its trailing earnings multiple of 194 and forward earnings multiple of 130 also point toward a steep valuation.

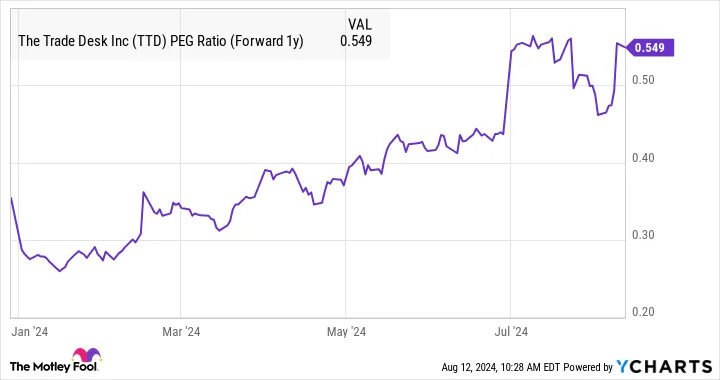

However, there is one valuation metric that tells us that growth investors can still consider buying The Trade Desk. The stock's price/earnings-to-growth ratio (PEG), which takes into account its potential earnings growth, stands at 0.55, as we can see in the chart below.

The PEG ratio is a forward-looking valuation metric calculated by dividing a company's price-to-earnings ratio by the expected earnings growth it could clock in future years. A reading of less than 1 means a stock is undervalued with respect to the growth it could deliver.

So, investors looking to add a growth stock to their portfolios can take a closer look at The Trade Desk despite its rich earnings and sales multiples. Those concerned about its valuation would do well to capitalize on any potential pullbacks to buy the shares to take advantage of the healthy long-term growth opportunity it is sitting on.

Before you buy stock in The Trade Desk, consider this: