Is Capital One Stock a Buy?

Financial stocks have gone on a tear over the past year as hopes of interest rate cuts from the Federal Reserve have boosted the interest rate-sensitive businesses. Capital One (NYSE: COF) has been one beneficiary, with its stock surging 49% since last November.

However, investors' focus has shifted to the weakening consumer. In a recent jobs report update, the unemployment rate rose for the fourth consecutive month , and stocks broadly sold off. In their second-quarter earnings calls, banks noted consumer spending was slowing down across specific market segments. Not only that, but charge-offs continued to rise industrywide.

Capital One's customer base could be particularly vulnerable in this environment, and in the second quarter, charge-offs on credit cards and auto loans ticked higher. With this in mind, is Capital One stock a good buy today?

Credit card charge-offs have risen several quarters in a row

Financial institutions face an uncertain environment today. Consumer metrics have been weakening as banks have increased reserves for credit losses and charged off bad loans for several quarters in a row. As one of the country's largest consumer credit card companies, Capital One is especially vulnerable to a weakening consumer.

In the second quarter, the company saw the net charge-off rate on its credit card loans rise to 6%, an increase from 5.9% in Q1 and 4.4% one year ago. The company charged off $2.6 billion in loans during the quarter, roughly in line with last quarter and up from $2.2 billion last year. It also recorded a provision for credit losses of $3.9 billion to account for potential future charge-offs.

According to The Fly, in a research note to investors in early July, one analyst at JPMorgan projects a seasonal decline in net charge-offs in the middle part of this year, with a seasonal rebound in the fourth quarter going into the first quarter of next year. This development would be a positive for Capital One and could allow it to release reserves, which would boost its net income.

During its earnings call, CEO Richard Fairbank noted that a new seasonal trend seems to have emerged over the past few years, driven by the timing of taxes and tax refunds due to changes made four years ago. As a result, losses appear to be seasonally lower in the third quarter and highest in the first quarter. For that reason, Fairbank is a little more cautious, stating, "We're not giving really forward guidance about declaration of a peak" in the company's allowance for credit losses.

Capital One has a broader customer base and is exposed to more customers across the entire credit spectrum. For example, 31% of its credit card customers and 47% of its auto loan customers have FICO scores of 660 or lower, which is considered below prime. The consumers on the lower end of the spectrum could face more difficulties if there is an economic slowdown.

Despite the caution, there are some positive takeaways. Capital One's 30-day delinquency rate has fallen to 4.17% from 4.5% in the first quarter. Delinquency rates can be a leading indicator for net charge-offs, and seeing this fall is a good sign.

Not only that, but charge-offs have gradually risen for the past couple of years since the Federal Reserve began raising interest rates. However, banks haven't seen a sudden spike in delinquencies, which suggests that consumers are holding up well thus far.

What's next for Capital One?

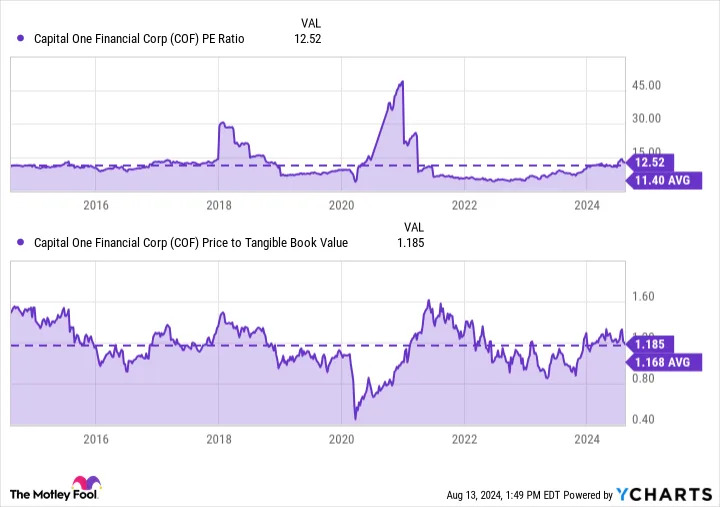

The stock is valued at a price-to-earnings ratio of 12.5 and a price-to-tangible book value of 1.18, both of which are slightly higher than its 10-year average. The stock isn't particularly cheap in that sense, so investors don't necessarily need to rush in to buy Capital One right now.

You will want to pay attention to its third-quarter credit metrics. Fairbank said that things should improve in Q3 but that he will be paying particularly close attention to October, where there can sometimes be an "October surprise" in consumer credit metrics.

Looking toward the future, one significant tailwind for Capital One would be its merger with Discover Financial Services . Earlier this year, the two companies agreed to a merger valued at $35 billion. It would be one of the largest bank mergers in U.S. history, and the deal has faced heavy scrutiny from lawmakers.

If it were to go through, it would enable Capital One to create a closed-loop payment network, much like American Express , and allow it to compete against Visa 's and Mastercard 's networks. For now, the merger is up in the air, and a decision is expected by the end of this year.

Is Capital One Stock a buy?

Capital One faces near-term headwinds as questions about consumer strength linger, which could leave the stock vulnerable to volatility in the short term. Therefore, you don't need to rush to buy the stock today.

However, I am bullish on the company long-term, especially if its merger with Discover is approved, which I believe it will be. For that reason, a smart strategy could be to build a small position while setting aside additional capital to buy more stock if there is a market sell-off in the short term.

Before you buy stock in Capital One Financial, consider this: