Here's Why 3M Stock Could Soar by at Least 28% Based on Management's Plans

By now, investors in 3M (NYSE: MMM) will know that the stock has appreciated significantly after the second-quarter earnings presentation. While the full-year earnings outlook improved slightly, the increase in the stock price is probably more attributable to new CEO William Brown's outline of his plan to generate value for investors. I want to focus on one essential part of his plans, which is that investors could lead to a substantial increase in the share price.

3M's new CEO makes plans

Brown's comprehensive presentation stressed the need for 3M to grow organically and improve margin performance by rejuvenating its research & development (R&D) activity to generate new product introductions (NPI). That aim fits the 3M model of R&D to create differentiated products that command pricing power and lead to volume growth. In turn, the volume growth leads to margin expansion due to building production scale and lowering cost per unit.

That said, it will take time for a change in R&D to come to fruition, so in the near term, Brown said the focus will be on "commercial excellence to sell more of what we currently offer, and that means better sales force and distributor effectiveness."

Brown's plans are numerous, but one aspect, namely reducing inventory as a share of the cost of goods sold, is exciting and could lead to a significant increase in shareholder value.

Why reducing inventory matters

Brown argued that "we have too much inventory at about $4 billion" and explained, "Our bottoms-up analysis indicates we should be closer to 75 days of inventory or lower, which would imply about $1 billion cash opportunity over time." Allow me to unpack those statements and why they are so important.

Inventory means the value of products for sale, unfinished products, and raw materials held by the company at a point in time. The higher the inventory, the more cash the company ties up in it. Inventory is usually compared to the cost of goods sold (COGS) to measure how many days in a year it is held before being sold.

Digging into the numbers:

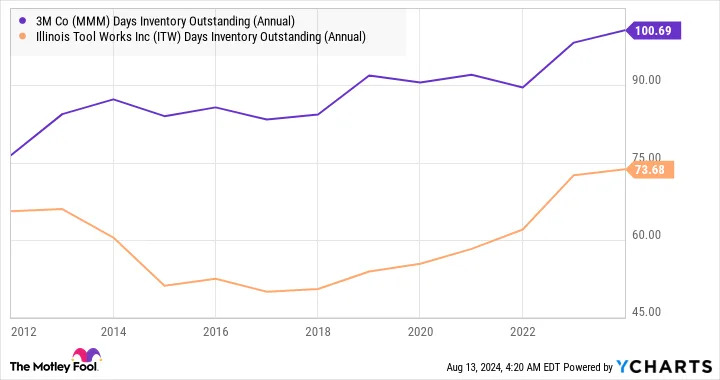

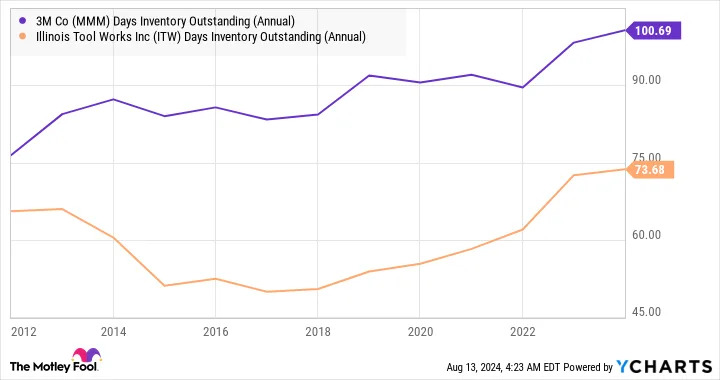

A quick look at 3M's long-term days inventory outstanding (a higher number is worse) confirms the deterioration in 3M's figure over time.

Brown plans to reduce the days of inventory outstanding to 75 days, a figure closer to that of its industrial peer, Illinois Tool Works . Doing so will free up a lot of cash.

Playing with some numbers, if 3M's days of inventory outstanding had been 75 days, then the quarterly inventory over COGS would be 0.82. With COGS at $2.94 billion, that means, under Brown's target, inventory would have been $2.94 billion rather than the $4.06 billion reported at the end of the second quarter, a difference of $1.1 billion.

What saving $1.1 billion in inventory could mean to 3M's share price

Wall Street believes 3M's free cash flow (FCF) will average about $3.9 billion over the next three years. If 3M frees up $1.1 billion in cash, that figure could be $5 billion, representing a 28% increase on the estimated $3.9 billion average over the next few years. As such, if the market values the company at the same price as the FCF ratio, 3M could have a stock appreciation of 28%.

Moreover, as the chart above shows in relation to Illinois Tool Works' management starting a fundamental restructuring of the company in 2013, it's possible for inventory days to decrease. Moreover, as implied by reducing inventory, an increase in cash flow can occur while management works to improve 3M's organic growth rate.

All told, if Brown realizes his plan on inventory, 3M shares will likely rise significantly.

Before you buy stock in 3M, consider this: