Is AST SpaceMobile a Millionaire-Maker Stock?

The latest exciting news out of AST SpaceMobile (NASDAQ: ASTS) is that it has delivered five satellites to Cape Canaveral. This is the first step toward actually offering the space-based cellular broadband network it is building. If it can get that system up and running, AST SpaceMobile could be a millionaire-maker stock. But don't get too excited; this is just one small step on the road to a full-fledged service offering.

AST SpaceMobile doesn't have a service to sell

The problem with AST SpaceMobile today is that it really only has one functioning satellite in orbit. That satellite was put up in late 2022 and was used to prove that the company's goal of creating a space-based cellular broadband network that worked with existing cellphones was possible. Right now, that's all AST SpaceMobile has to offer the world -- a successful proof of concept.

That proof of concept, however, was enough to get telecom giants AT&T (NYSE: T) and Verizon (NYSE: VZ) on board as investors. There are two benefits here. First, AST SpaceMobile has access to some deep pockets as it looks to raise cash. Second, AST SpaceMobile will have built-in customers when it finally starts to get additional satellites into space so it can operate a commercial service. Inking such partnerships was a key goal for management, and these two agreements, among other partnerships, are an important foundation for the future.

That future, meanwhile, is starting to look more and more interesting. AST SpaceMobile has completed the construction of five commercial satellites and has now delivered them to Cape Canaveral. Although there's no guarantees, the hope is that they will get launched in September. It is highly unlikely that the company will instantly be up and running, though, as the satellites will have to be deployed and tested before they can really start serving customers. But AST SpaceMobile is on the cusp of having a real business.

There's a long way to go for AST SpaceMobile

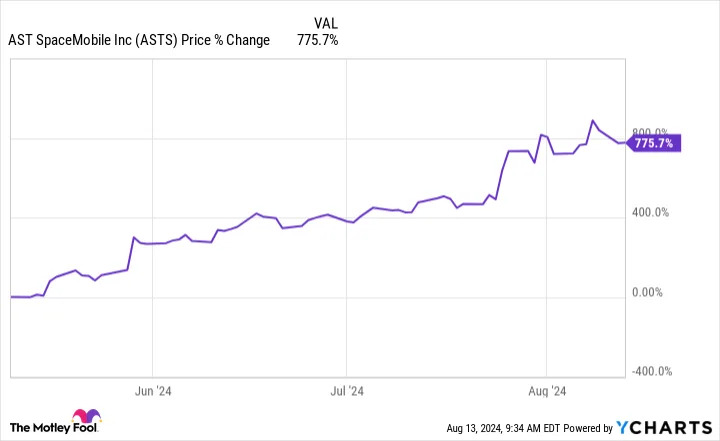

The notable progress being made over the last few months is why the stock has spiked higher. In just three months, the stock has risen more than 700%! That's a huge gain in a very short period of time, and it prices in a lot of good news. Of course, if AST SpaceMobile can get its space-based cellular broadband network up and running, there could still be more big gains ahead. It could, indeed, still help make more aggressive investors into millionaires.

The key here, however, is that an investment here is best suited to aggressive investors. The company is very clear, stating in the risks section of its 10-K that "We will continue to incur operating and net losses each quarter until at least the time we begin generating revenue as a result of planned launches of our commercial satellites and may continue to incur operating or net losses even after we begin generating revenue."

The first goal is obviously putting up the five satellites it has ready for launch. However, after that, it has plans to produce and launch 20 more. That's a task that the company believes could cost as much as $400 million, at last estimate. Even that, however, won't be enough. The company's longer-term goal is to get 95 satellites in orbit. If 20 satellites cost $400 million, building 90 will push the cost to roughly $1.8 billion without taking into account inflationary issues that may push the price tag even higher over time or cost efficiency from higher volume production that could reduce the per unit cost.

Given that there are huge costs ahead, there's a chance that investors are getting a little ahead of the curve with the stock today. Perhaps, over the long term, the price today will seem reasonable (at least in hindsight), but with so much work yet to be done, only the most aggressive investors should buy AST SpaceMobile stock today after the massive stock price advance.

There are opportunities and risks here

AST SpaceMobile has made huge strides on the business front in a very short period of time. So, there are reasons to be positive about the future and to think that this could be a millionaire-maker stock. However, the business success has translated into a massive stock price advance, which may be baking in a lot of good news in too short a period of time. Young companies that are spending heavily to build a business tend to be volatile even if the general stock trend is upward over the long term. It wouldn't be shocking to see a sharp pullback after such a large advance, which is why AST SpaceMobile is probably most appropriate for aggressive investors willing to stick it out for the long term. Or, conversely, you could just watch and wait for a pullback before pulling the trigger.

Before you buy stock in AST SpaceMobile, consider this: