Here's the Number Every C3.ai Stock Investor Needs to Watch in September

Founded in 2009, C3.ai (NYSE: AI) was one of the world's first enterprise artificial intelligence (AI) companies. It has built a portfolio of over 40 ready-made AI applications for businesses in 19 different industries, including financial services, energy, and manufacturing.

Those businesses can integrate the apps directly into their operations, saving them the time and money otherwise required to build their own from scratch.

Around two years ago, C3.ai abandoned its subscription-based revenue model in favor of a consumption-based model instead. It eliminates lengthy negotiating processes, which allows the company to onboard customers more quickly, and they only pay for what they use.

C3.ai warned investors this transition would cause a temporary slowdown in its revenue growth because it would take time for customers to ramp up their consumption. Sure enough, quarterly revenue actually started to shrink (year over year) less than one year after the announcement.

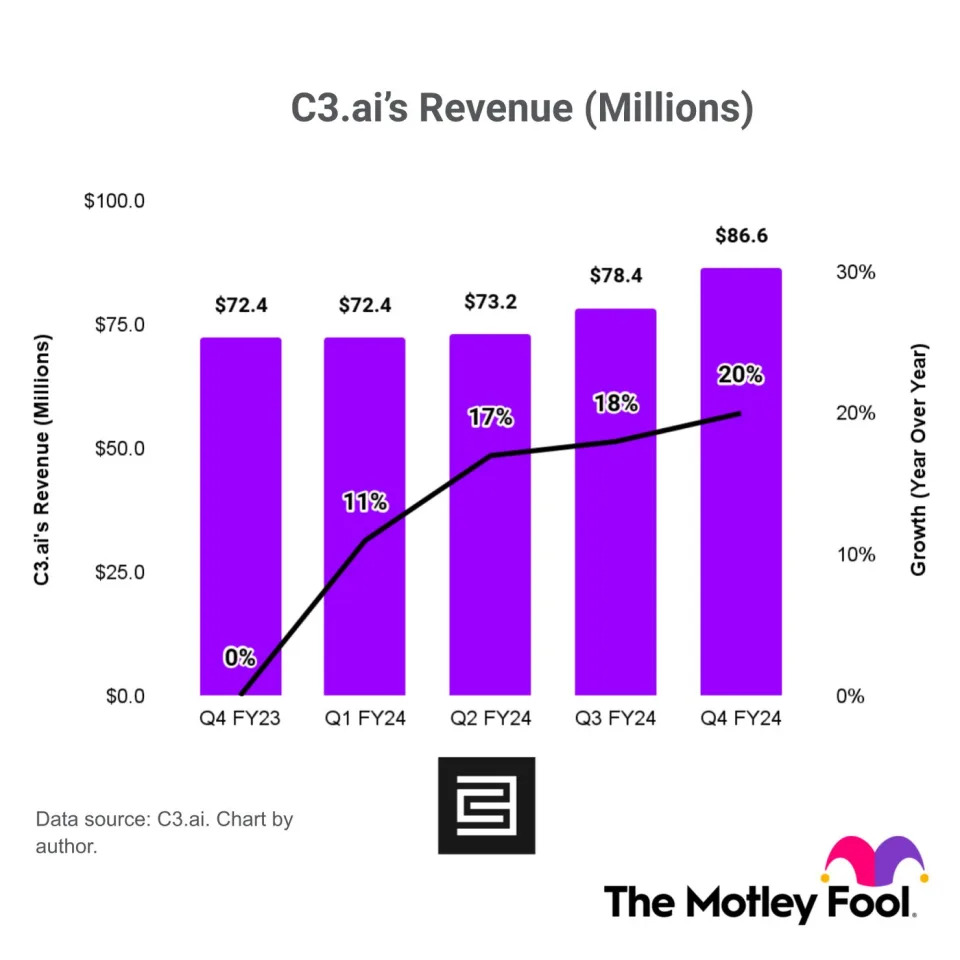

However, C3.ai was confident the move to consumption-based pricing would pay off long term. The company's latest results are starting to support that view as revenue growth has accelerated in each of the last five quarters:

C3.ai is due to report its fiscal 2025 first quarter (ending July 31) results in the first week of September. The company's guidance suggests it could report revenue growth of as high as 23%, which would mark yet another quarter of acceleration.

The stock currently trades at a price to sales (P/S) ratio of 9.9, which is 41% below its average of 16.7 since becoming a public company nearly four years ago. Accelerating revenue growth should lead to a higher stock price if the P/S ratio remains unchanged, but even its valuation multiple could climb if the top-line momentum holds. Investors should keep an eye out for the September report.

Before you buy stock in C3.ai, consider this: