2 Biotech Stocks to Buy Hand Over Fist in August

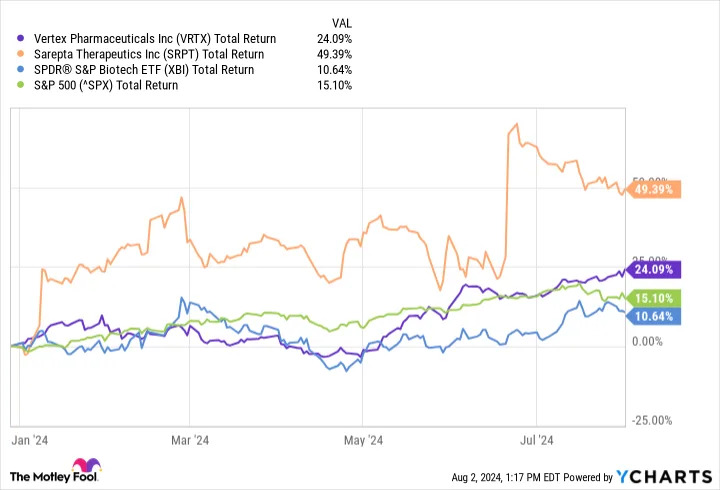

We are still in a bull market, but the biotech industry, as measured by the SPDR S&P Biotech ETF (an industry benchmark), hasn't been keeping up with broader equities this year. That's no reason to avoid biotech stocks -- after all, some are doing just fine.

That's the case with Vertex Pharmaceuticals (NASDAQ: VRTX) and Sarepta Therapeutics (NASDAQ: SRPT) . Although these drugmakers continue to perform well, both look to have plenty of upside. Let's find out why it's worth buying shares of each.

1. Vertex Pharmaceuticals

A glance at Vertex Pharmaceuticals' financial results over the past few quarters might give investors the wrong idea. Revenue hasn't been growing at a particularly impressive rate; in the second quarter, Vertex's top line was up 6% year over year to $2.65 billion. But that hardly tells the whole story.

Vertex is still rolling out its latest approval, Casgevy, a gene-editing treatment for sickle cell disease and transfusion-dependent beta-thalassemia. Like all gene-editing treatments, Casgevy is complex to administer. It takes specialized facilities, equipment, and especially trained medical staff. It has been on the market for just over eight months in various countries. While it might take a while, Casgevy's revenue will start ramping up eventually, boosting Vertex's top-line growth rate.

And there's more. The company is currently awaiting two key approvals. The first is for suzetrigine, a potential therapy for acute pain. The second, known as the "vanza triple," is yet another breakthrough in the field Vertex dominates: cystic fibrosis (CF). Both could earn the green light early next year -- to become more sources of revenue for the biotech.

There will also be more opportunities after that, as Vertex Pharmaceuticals' other pipeline candidates make headway. Inaxaplin, a potential therapy for APOL-1 mediated kidney disease, is now in phase 3 studies. The company plans to start another late-stage trial for suzetrigine in treating pain associated with diabetic peripheral neuropathy. And Vertex has many more exciting programs in earlier stages of development.

So, although the biotech continues to deliver excellent returns, there remains substantial upside ahead. That's why the company is worth investing in this month.

2. Sarepta Therapeutics

Sarepta Therapeutics specializes in developing gene therapies for rare diseases, especially Duchenne muscular dystrophy (DMD), a progressive neuromuscular condition typically diagnosed in boys.

This biotech has four approved DMD treatments on the market, including Elevidys, the only one in its portfolio that addresses the underlying causes of DMD. Elevidys recently earned full approval in treating ambulatory patients. The therapy is also under accelerated approval for non-ambulatory patients, meaning that Sarepta will have to conduct post-marketing studies to be permanently granted the green light by regulatory authorities for this indication.

Elevidys is helping boost Sarepta's revenue. In the second quarter, the company's top line soared by 39% year over year to $362.9 million. The biotech turned an adjusted net loss of $1.01 in the second quarter of 2023 into an adjusted net income per share of $0.44. Sarepta also recorded $121.7 million in sales from Elevidys and an additional $2.4 million in royalty revenue from Roche , with which it developed the gene therapy.

If the biotech can earn full approval for Elevidys for non-ambulatory patients, that will be yet another boost. Sarepta is also developing newer therapies, including in DMD. It's branching out, though. In January, it started screening patients for phase 3 studies of a potential treatment for a rare disease called limb-girdle muscular dystrophy (LGMD).

The company has over 40 programs in development, an impressive number for a drugmaker that technically qualifies as a large-cap stock -- its market capitalization is $13.4 billion -- but that isn't nearly as prominent as the biggest players in the biotech industry .

Sarepta Therapeutics has the funds, the pipeline, and the innovative abilities to deliver key clinical and regulatory progress in the next five years. The stock could provide outsized returns.

Before you buy stock in Vertex Pharmaceuticals, consider this: