4 Reasons to Buy Dutch Bros Stock Like There's No Tomorrow

Upstart coffee and hand-crafted beverages chain Dutch Bros (NYSE: BROS) released its earnings report on Aug. 7. The company grew sales and adjusted earnings per share (EPS) by 30% and 46%, respectively, topping analysts' expectations. Despite these impressive results, the market sent Dutch Bros' stock down roughly 21% as the company admitted that its new store openings would be closer to the lower end of its 150- to 165-shop count in 2024.

While this reaction to the potential of slowing expansion plans is understandable for a growth stock like Dutch Bros, wiping away one-fifth of the company's value in 24 hours seems like an overreaction. Thanks to this significant drop -- and the four reasons I will discuss below -- I can't help but be optimistic about Dutch Bros shares now.

1. Dutch Bros' growth marathon is in its early miles

Even though the company more than doubled its shop count from 441 locations in 2020 to today's 900-plus stores, roughly 75% of Dutch Bros' locations are in just five states: Washington, Oregon, California, Arizona, and Texas. This unique density of locations in certain states is attractive in regard to the company's long-term potential for two reasons.

The first one is quite simple -- there is a massive greenfield expansion opportunity ahead for the company. It's currently only operating in 16 states across the western and southern portions of the United States, but Dutch Bros believes its store count could grow to over 4,000 in the decades ahead as it expands geographically.

Secondly, despite being heavily concentrated in five key states, the company is profitable. It's shown that it is capable of effectively adding new stores in a given city or state where it already operates without eating into its own profits.

2. Dutch Rewards members

Part of the reason that Dutch Bros has proven successful at growing its store count without having to rely heavily upon geographic expansion so far is that it has a very loyal customer base. It's generating 67% of its transactions from Dutch Rewards members as of its most recent quarter, so the company's ability to retain customers is top-tier.

Furthermore, this successful rewards program allows the company to glean insights from its customers. This data helps Dutch Bros create offerings its members would be interested in, and later enables the company to promote these new products directly to its members, keeping them engaged with the brand.

3. Innovating to maintain high customer satisfaction

Powered by these insights, Dutch Bros is able to launch new product ideas, such as its new Poppin' Boba beverages, protein coffees, or its limited-time "Gold Medal Rebel" energy drink. Dutch Bros generates roughly 50% of its sales from coffee, 25% from energy drinks, and 25% from teas, lemonades, smoothies, and sodas.

In addition to new flavors, the company collects ideas that its customers would like to see implemented, such as mobile order-ahead capabilities. It's rapidly testing and implementing this idea, and Dutch Bros believes the majority of its stores will support order-ahead purchases by the end of the year.

In addition to ordering ahead, Dutch Bros focuses on locations that use "escape lanes," which let customers leave as soon as their order is ready, and walk-up windows for non-drive-thru purchases.

4. A recently discounted (and maybe cheap) valuation

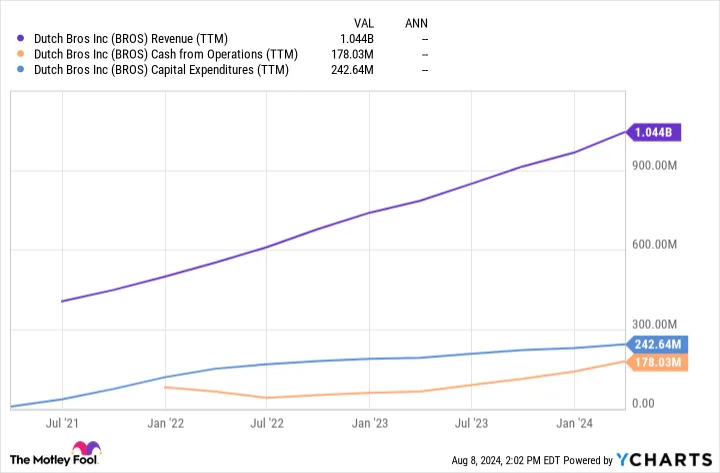

While it is difficult to assign a valuation to growth stocks like Dutch Bros, its price-to-sales (P/S) ratio of 1.9 is below that of the S&P 500 index's average of 2.8 despite the company's much faster growth rate. Additionally, while Dutch Bros has yet to reach positive free cash flow (FCF) due to its heavy spending on capital expenditures (capex) for new stores, its cash from operations (CFO) is robust, equaling 17% of sales.

What this 17% margin means is that if the company decided it was done building new stores and would only spend capex on maintenance, it would create gobs of FCF for investors (as FCF equals CFO minus capex).

On a price-to-CFO basis, the company seems deeply discounted. It's even trading at a valuation below that of its massive peer, Starbucks , which already has 18 times more locations than Dutch Bros in the U.S.

As cheap as its valuations may be, however, Dutch Bros needs to be monitored for continued shareholder dilution. Simply put, the company is famous for issuing new shares to fund its growth -- more than doubling its outstanding shares since its initial public offering in 2021. As Dutch Bros grows, it will be essential for investors to see the company eventually generate enough CFO to self-fund its capex over the next year or so, making it a more shareholder-friendly growth machine.

Before you buy stock in Dutch Bros, consider this: